Asuransi car, or car insurance, is a contract between you and an insurance company. It protects you financially if you are in a car accident. Car insurance can cover the costs of damage to your car, as well as the costs of medical expenses and lost wages.

Having car insurance is important because it can help you to protect your finances in the event of an accident. Car insurance can also give you peace of mind, knowing that you are financially protected if something happens.

There are many different types of car insurance available, so it is important to shop around and compare quotes to find the policy that is right for you. You should also make sure that you understand the terms of your policy before you sign it.

Asuransi Car

Asuransi car, or car insurance, plays a crucial role in safeguarding individuals financially in the event of car accidents. It encompasses various key aspects, each of which contributes to its overall significance and relevance:

- Protection: Asuransi car provides financial protection against damages and liabilities incurred in car accidents.

- Legal Requirement: In many jurisdictions, having car insurance is a legal requirement for operating a vehicle.

- Peace of Mind: It offers peace of mind, knowing that financial assistance is available in case of an accident.

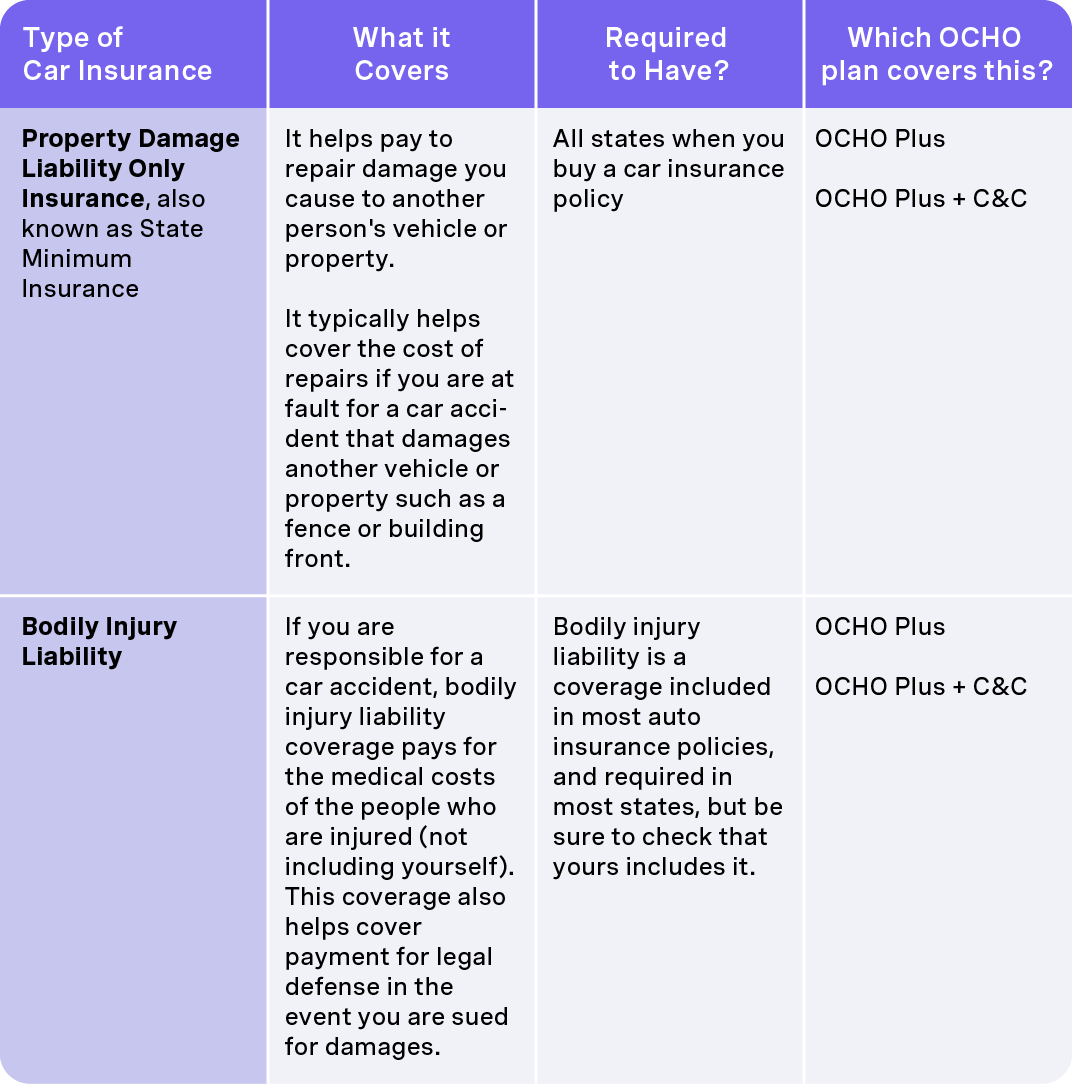

- Coverage Options: Asuransi car offers a range of coverage options, allowing individuals to tailor their policies based on specific needs and risks.

- Claims Process: The claims process is designed to be efficient and hassle-free, ensuring timely financial assistance.

- Premiums and Deductibles: Premiums and deductibles vary depending on factors such as driving history, vehicle type, and coverage level.

In conclusion, asuransi car serves as a comprehensive financial safety net for car owners. It not only protects against financial burdens but also provides legal compliance and peace of mind. Understanding these key aspects is essential for individuals seeking adequate car insurance coverage.

Protection

The significance of “Protection: Asuransi car provides financial protection against damages and liabilities incurred in car accidents” as a component of “asuransi car” cannot be overstated. Asuransi car serves as a financial safety net, safeguarding individuals from the potentially devastating financial consequences of car accidents.

In the unfortunate event of a car accident, asuransi car provides coverage for various expenses, including:

- Vehicle repairs or replacement: Asuransi car covers the costs of repairing or replacing your vehicle if it is damaged or destroyed in an accident.

- Medical expenses: Asuransi car provides coverage for medical expenses incurred by you or your passengers as a result of an accident.

- Legal liability: Asuransi car provides coverage if you are found legally liable for damages or injuries caused to others in an accident.

Without adequate asuransi car coverage, individuals may face significant financial burdens, including high repair costs, medical bills, and legal expenses. Asuransi car acts as a crucial financial protection mechanism, ensuring that individuals are not left financially vulnerable in the aftermath of a car accident.

Understanding the importance of “Protection: Asuransi car provides financial protection against damages and liabilities incurred in car accidents” empowers individuals to make informed decisions regarding their car insurance coverage. By securing comprehensive asuransi car coverage, individuals can safeguard their financial well-being and ensure peace of mind on the road.

Legal Requirement

The legal requirement for car insurance serves as a cornerstone of “asuransi car” and plays a multifaceted role in ensuring road safety and financial protection.

- Public Safety: Car insurance promotes public safety by ensuring that all drivers on the road have a minimum level of financial responsibility. This helps to deter reckless driving and reduces the likelihood of uninsured drivers causing accidents.

- Financial Protection: Car insurance provides financial protection to both at-fault and non-at-fault drivers involved in accidents. It ensures that victims have access to compensation for damages and medical expenses, regardless of who caused the accident.

- Legal Compliance: Having car insurance is a legal requirement in many jurisdictions. Failing to maintain insurance coverage can result in penalties, fines, and even the suspension or revocation of a driver’s license.

- Peace of Mind: Car insurance provides peace of mind to drivers, knowing that they are financially protected in the event of an accident. This allows them to drive with confidence and reduces the stress associated with potential financial liabilities.

The legal requirement for car insurance is closely intertwined with “asuransi car” and underscores its importance in promoting road safety, providing financial protection, and ensuring legal compliance. Understanding this legal requirement empowers individuals to make informed decisions about their car insurance coverage and contribute to a safer driving environment for all.

Peace of Mind

The component “Peace of Mind: It offers peace of mind, knowing that financial assistance is available in case of an accident” holds immense significance within the realm of “asuransi car.” It encapsulates the invaluable psychological and emotional benefits that car insurance provides to policyholders.

Asuransi car acts as a powerful stress reliever, providing drivers with a sense of security and confidence on the road. Knowing that they have financial protection in the event of an accident can significantly reduce anxiety and worry associated with driving. This peace of mind allows drivers to focus on the road and enjoy their driving experience without the burden of financial concerns.

Real-life examples abound to illustrate the practical significance of this peace of mind. Consider a scenario where a driver is involved in an accident and sustains injuries. The financial burden of medical expenses, vehicle repairs, and potential legal liability can be overwhelming. However, having comprehensive asuransi car coverage can alleviate these concerns, providing the policyholder with peace of mind knowing that the financial repercussions will be taken care of.

Understanding the connection between “Peace of Mind: It offers peace of mind, knowing that financial assistance is available in case of an accident” and “asuransi car” empowers individuals to recognize the true value of car insurance beyond its legal and financial aspects. It underscores the importance of prioritizing peace of mind and financial security when making decisions about car insurance coverage.

Coverage Options

The vast array of coverage options available in asuransi car empowers policyholders to customize their insurance policies to align with their unique needs and risk profiles. This flexibility is a defining characteristic of asuransi car, allowing individuals to achieve optimal protection and peace of mind.

- Comprehensive Coverage: This option provides the most comprehensive protection, covering a wide range of potential risks, including accidents, theft, and natural disasters.

- Collision Coverage: This option covers damage to your vehicle caused by a collision with another vehicle or object.

- Liability Coverage: This option covers your legal liability for injuries or property damage caused to others in an accident.

- Medical Payments Coverage: This option covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

The ability to tailor coverage options allows individuals to strike a balance between their financial resources and their risk tolerance. By carefully considering their specific circumstances and driving habits, policyholders can select the coverage options that best suit their needs, ensuring adequate protection without overpaying for unnecessary coverage.

Claims Process

The efficient and hassle-free claims process is a cornerstone of “asuransi car,” ensuring that policyholders receive timely financial assistance in the event of an accident. This streamlined process is designed to minimize stress and provide peace of mind during a challenging time.

- Prompt and Professional Response: Asuransi car providers prioritize prompt and professional responses to claims, acknowledging claims quickly and assigning dedicated representatives to guide policyholders through the process.

- Easy-to-Access Documentation: Claims processes are designed to be user-friendly, with clear instructions and easily accessible documentation requirements. This ensures that policyholders can submit their claims efficiently without unnecessary delays.

- Transparent Communication: Throughout the claims process, asuransi car providers maintain transparent communication, keeping policyholders informed of the progress and status of their claims.

- Fair and Equitable Settlements: Asuransi car providers are committed to fair and equitable settlements, ensuring that policyholders receive appropriate compensation for their losses.

The efficient and hassle-free claims process in “asuransi car” is not merely a procedural formality but a tangible representation of the insurer’s commitment to supporting policyholders in their time of need. By providing timely financial assistance and simplifying the claims process, asuransi car empowers policyholders to recover from accidents with minimal disruption and stress.

Premiums and Deductibles

The interplay between premiums and deductibles lies at the heart of “asuransi car,” directly influencing the cost and coverage of car insurance policies. Premiums, the regular payments made by policyholders, are calculated based on various factors, including driving history, vehicle type, and coverage level. Deductibles, on the other hand, represent the amount that policyholders must pay out of pocket before insurance coverage kicks in.

Understanding the connection between premiums and deductibles is crucial for optimizing “asuransi car” policies. Drivers with a history of accidents or traffic violations may face higher premiums, as they are considered higher risk. Similarly, insuring a luxury vehicle or opting for comprehensive coverage will generally result in increased premiums. Conversely, maintaining a clean driving record and choosing a vehicle with good safety ratings can lead to lower premiums.

The choice of deductible also significantly impacts the cost of “asuransi car.” A higher deductible lowers the premium, but it also means that the policyholder will have to pay more out of pocket in the event of a claim. Selecting an appropriate deductible requires careful consideration of financial circumstances and risk tolerance.

In summary, premiums and deductibles are essential components of “asuransi car,” directly affecting the cost and coverage of insurance policies. Understanding the relationship between these factors enables policyholders to make informed decisions, balancing their financial resources with their desired level of protection.

Frequently Asked Questions on “Asuransi Car”

This section addresses commonly asked questions and misconceptions surrounding “asuransi car” to provide a deeper understanding of car insurance and its benefits.

Question 1: What is the purpose of “asuransi car”?

Asuransi car, or car insurance, serves the primary purpose of providing financial protection to policyholders in the event of car accidents. It covers expenses related to vehicle repairs or replacement, medical costs, and legal liabilities arising from accidents.

Question 2: Is “asuransi car” mandatory by law?

In many jurisdictions, having car insurance is a legal requirement. Operating a vehicle without valid car insurance can result in penalties, fines, or even suspension of driving privileges.

Question 3: What are the different types of coverage available in “asuransi car”?

Asuransi car offers a range of coverage options, including comprehensive coverage, collision coverage, liability coverage, and medical payments coverage. Each type of coverage provides varying levels of protection against specific risks.

Question 4: How are premiums and deductibles determined in “asuransi car”?

Premiums, the regular payments made by policyholders, are influenced by factors such as driving history, vehicle type, and coverage level. Deductibles, the amount paid out of pocket before insurance coverage applies, can be adjusted to balance the cost of premiums.

Question 5: What is the claims process like in “asuransi car”?

Asuransi car providers prioritize efficient and hassle-free claims processes. Policyholders can expect prompt responses, clear communication, and fair claim settlements.

Question 6: How can I find the best “asuransi car” policy for my needs?

Comparing quotes from different insurance providers, understanding coverage options, and assessing personal risk tolerance are crucial steps in finding the most suitable “asuransi car” policy.

Summary:

Asuransi car plays a vital role in protecting individuals from the financial consequences of car accidents. It offers peace of mind, legal compliance, and a range of coverage options tailored to specific needs. Understanding the key aspects of “asuransi car” empowers individuals to make informed decisions and secure adequate protection on the road.

Transition to the next article section:

The following section will explore the importance of choosing the right “asuransi car” policy and provide tips for finding the best coverage for your needs.

Tips for Choosing the Right Asuransi Car

Securing the right asuransi car policy is crucial for optimal protection and peace of mind on the road. Here are several key tips to consider when making your decision:

Tip 1: Assess Your Coverage Needs

Evaluate your driving habits, vehicle type, and financial situation to determine the appropriate coverage level. Consider factors such as comprehensive coverage, collision coverage, liability coverage, and medical payments coverage.

Tip 2: Compare Quotes from Multiple Insurers

Obtain quotes from several reputable asuransi car providers to compare coverage options and premiums. This allows you to find the best combination of protection and affordability.

Tip 3: Consider Your Deductible

Choose a deductible that balances your risk tolerance and financial capabilities. A higher deductible lowers your premium, but you will need to pay more out of pocket in the event of a claim.

Tip 4: Check for Discounts and Promotions

Inquire about potential discounts and promotions offered by asuransi car providers. These may include discounts for good driving records, multiple policies, or safety features in your vehicle.

Tip 5: Read the Policy Carefully

Thoroughly review the policy details to understand the coverage limits, exclusions, and any specific conditions that may apply.

Tip 6: Consider Additional Coverage Options

Explore additional coverage options such as roadside assistance, rental car reimbursement, or gap insurance to enhance your protection.

Tip 7: Maintain a Good Driving Record

Maintaining a clean driving record is essential for securing favorable asuransi car premiums and coverage options.

Summary:

By following these tips, you can make an informed decision when choosing an asuransi car policy that meets your specific needs and provides comprehensive protection on the road.

Transition to the article’s conclusion:

Choosing the right asuransi car policy is a crucial step towards ensuring financial protection and peace of mind while driving. By considering the factors and tips outlined above, you can secure optimal coverage that safeguards you and your vehicle against potential risks.

Kesimpulan Asuransi Mobil

Asuransi mobil, atau asuransi kendaraan bermotor, telah dieksplorasi secara mendalam dalam artikel ini, menyoroti aspek-aspek pentingnya, manfaatnya, dan opsi perlindungannya. Memahami berbagai komponen asuransi mobil memberdayakan individu untuk membuat keputusan tepat yang sesuai dengan kebutuhan dan profil risiko mereka.

Memilih polis asuransi mobil yang tepat sangat penting untuk memastikan perlindungan finansial dan ketenangan pikiran saat berkendara. Dengan mempertimbangkan faktor-faktor dan tip yang telah diuraikan, individu dapat memperoleh perlindungan optimal yang menjaga mereka dan kendaraan mereka dari potensi risiko di jalan.