Asuransi comprehensive is a type of insurance that provides comprehensive coverage for your vehicle, including damage caused by accidents, theft, vandalism, and natural disasters. Unlike third-party insurance, comprehensive insurance covers damage to your own vehicle, regardless of who is at fault.

There are many benefits to having comprehensive insurance. First, it can help you to protect your financial investment in your vehicle. If your car is damaged or stolen, comprehensive insurance can help you to replace or repair it without having to pay for the full cost out of pocket. Second, comprehensive insurance can provide you with peace of mind knowing that you are protected against unexpected events.

Comprehensive insurance is an important part of protecting your vehicle and your finances. If you are looking for a way to protect your investment and give yourself peace of mind, then comprehensive insurance is a good option for you.

Asuransi Comprehensive Artinya

Asuransi comprehensive, or comprehensive insurance, is an important part of protecting your vehicle and your finances. It provides coverage for a wide range of events, including accidents, theft, vandalism, and natural disasters. Here are six key aspects of comprehensive insurance that you should know:

- Coverage: Comprehensive insurance provides coverage for damage to your vehicle, regardless of who is at fault.

- Peace of mind: Comprehensive insurance can give you peace of mind knowing that you are protected against unexpected events.

- Financial protection: Comprehensive insurance can help you to protect your financial investment in your vehicle.

- Replacement cost: Comprehensive insurance can help you to replace your vehicle if it is stolen or totaled.

- Repair costs: Comprehensive insurance can help you to pay for the cost of repairing your vehicle if it is damaged.

- Deductible: Comprehensive insurance typically has a deductible, which is the amount you pay out of pocket before your insurance coverage kicks in.

When considering comprehensive insurance, it is important to weigh the costs and benefits. The cost of comprehensive insurance will vary depending on a number of factors, including the value of your vehicle, your driving record, and the insurance company you choose. However, the peace of mind and financial protection that comprehensive insurance provides can be well worth the cost.

Coverage

This aspect of comprehensive insurance is important because it means that you are protected financially even if you are not at fault for an accident. For example, if you are rear-ended by another driver, comprehensive insurance will cover the cost of repairing your vehicle, regardless of whether or not the other driver has insurance.

- No-fault coverage: Comprehensive insurance provides no-fault coverage, which means that you are not responsible for paying for damages if you are not at fault for an accident.

- Protection against uninsured drivers: Comprehensive insurance can protect you against uninsured drivers. If you are in an accident with an uninsured driver, comprehensive insurance will cover the cost of repairing your vehicle.

- Hit-and-run accidents: Comprehensive insurance can also cover the cost of repairing your vehicle if you are involved in a hit-and-run accident.

- Vandalism and theft: Comprehensive insurance can also cover the cost of repairing your vehicle if it is vandalized or stolen.

Overall, the coverage provided by comprehensive insurance is essential for protecting yourself financially in the event of an accident. If you are looking for a way to protect your investment and give yourself peace of mind, then comprehensive insurance is a good option for you.

Peace of mind

Asuransi comprehensive artinya comprehensive insurance provides peace of mind. This is because comprehensive insurance protects you against unexpected events, such as accidents, theft, vandalism, and natural disasters. With comprehensive insurance, you can rest assured knowing that you are financially protected in the event of an unexpected event.

For example, if you are in a car accident, comprehensive insurance will cover the cost of repairing your vehicle, regardless of who is at fault. This means that you do not have to worry about paying for expensive repairs out of pocket. Additionally, comprehensive insurance can also cover the cost of replacing your vehicle if it is stolen or totaled.

Overall, comprehensive insurance is a valuable investment that can give you peace of mind. If you are looking for a way to protect yourself financially against unexpected events, then comprehensive insurance is a good option for you.

Financial protection

Asuransi comprehensive artinya comprehensive insurance provides financial protection. This is because comprehensive insurance covers the cost of repairing or replacing your vehicle if it is damaged or stolen. This means that you do not have to worry about paying for expensive repairs or a new vehicle out of pocket.

For example, if you are in a car accident, comprehensive insurance will cover the cost of repairing your vehicle, regardless of who is at fault. This means that you do not have to worry about paying for expensive repairs out of pocket. Additionally, comprehensive insurance can also cover the cost of replacing your vehicle if it is stolen or totaled.

Overall, comprehensive insurance is a valuable investment that can protect your financial investment in your vehicle. If you are looking for a way to protect yourself financially against unexpected events, then comprehensive insurance is a good option for you.

Replacement cost

Asuransi comprehensive artinya comprehensive insurance provides comprehensive coverage for your vehicle, including the cost of replacing your vehicle if it is stolen or totaled. This is an important aspect of comprehensive insurance because it can help you to protect your financial investment in your vehicle.

For example, if your car is stolen, comprehensive insurance will cover the cost of replacing your vehicle with a new one of the same make and model. This means that you will not have to worry about paying for a new car out of pocket.

Similarly, if your car is totaled in an accident, comprehensive insurance will cover the cost of replacing your vehicle with a new one of the same make and model. This means that you will not have to worry about paying for a new car out of pocket.

Overall, the replacement cost coverage provided by comprehensive insurance is an important part of protecting your financial investment in your vehicle. If you are looking for a way to protect yourself financially against unexpected events, then comprehensive insurance is a good option for you.

Repair costs

Asuransi comprehensive artinya comprehensive insurance provides coverage for the cost of repairing your vehicle if it is damaged, regardless of who is at fault. This means that you do not have to worry about paying for expensive repairs out of pocket.

- Collision coverage: Comprehensive insurance includes collision coverage, which covers the cost of repairing your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive coverage: Comprehensive insurance also includes comprehensive coverage, which covers the cost of repairing your vehicle if it is damaged by something other than a collision, such as vandalism, theft, or natural disasters.

- No-fault coverage: Comprehensive insurance provides no-fault coverage, which means that you are not responsible for paying for damages if you are not at fault for an accident.

- Deductible: Comprehensive insurance typically has a deductible, which is the amount you pay out of pocket before your insurance coverage kicks in.

Overall, the repair cost coverage provided by comprehensive insurance is an important part of protecting your financial investment in your vehicle. If you are looking for a way to protect yourself financially against unexpected events, then comprehensive insurance is a good option for you.

Deductible

A deductible is an important aspect of comprehensive insurance (asuransi comprehensive artinya) because it helps to determine the cost of your insurance premium. The higher your deductible, the lower your insurance premium will be. However, the higher your deductible, the more you will have to pay out of pocket before your insurance coverage kicks in.

For example, if you have a $500 deductible and you file a claim for $1,000, you will be responsible for paying the first $500. Your insurance company will then cover the remaining $500.

It is important to choose a deductible that you are comfortable with. If you have a high deductible, you will have to pay more out of pocket in the event of a claim. However, you will also have a lower insurance premium. If you have a low deductible, you will have to pay less out of pocket in the event of a claim. However, you will also have a higher insurance premium.

When choosing a deductible, it is important to consider your financial situation and your risk tolerance. If you are on a tight budget, you may want to choose a higher deductible. However, if you are worried about having to pay a large amount of money out of pocket in the event of a claim, you may want to choose a lower deductible.

Asuransi Comprehensive Artinya FAQs

Comprehensive insurance, or asuransi comprehensive artinya in Indonesian, is a type of insurance that provides comprehensive coverage for your vehicle, including damage caused by accidents, theft, vandalism, and natural disasters. Here are six frequently asked questions (FAQs) about comprehensive insurance:

Question 1: What is comprehensive insurance?

Comprehensive insurance is a type of insurance that provides comprehensive coverage for your vehicle, regardless of who is at fault for an accident.

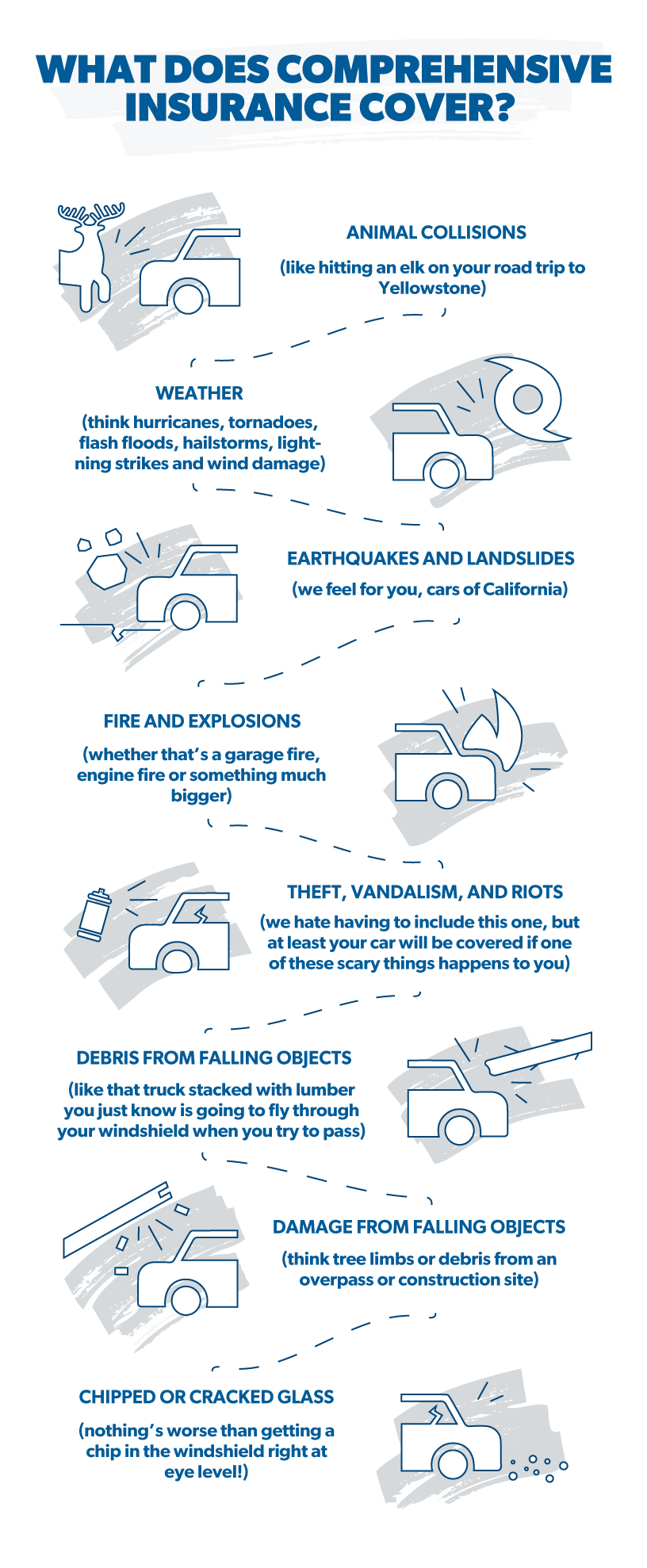

Question 2: What does comprehensive insurance cover?

Comprehensive insurance covers a wide range of events, including accidents, theft, vandalism, and natural disasters.

Question 3: How much does comprehensive insurance cost?

The cost of comprehensive insurance will vary depending on a number of factors, including the value of your vehicle, your driving record, and the insurance company you choose.

Question 4: Is comprehensive insurance worth it?

Whether or not comprehensive insurance is worth it depends on your individual circumstances. If you are looking for a way to protect your investment and give yourself peace of mind, then comprehensive insurance is a good option for you.

Question 5: What is the difference between comprehensive insurance and collision insurance?

Comprehensive insurance covers a wider range of events than collision insurance. Collision insurance only covers damage to your vehicle caused by a collision with another vehicle or object.

Question 6: How do I file a comprehensive insurance claim?

To file a comprehensive insurance claim, you should contact your insurance company as soon as possible after an accident or other covered event.

These are just a few of the most frequently asked questions about comprehensive insurance. If you have any other questions, please contact your insurance company for more information.

Asuransi comprehensive artinya comprehensive insurance provides peace of mind and financial protection for your vehicle. If you are looking for a way to protect your investment and give yourself peace of mind, then comprehensive insurance is a good option for you.

Next: Benefits of Comprehensive Insurance

Tips on Comprehensive Insurance (Asuransi Comprehensive Artinya)

Comprehensive insurance provides comprehensive coverage for your vehicle, including damage caused by accidents, theft, vandalism, and natural disasters. Here are five tips to help you get the most out of your comprehensive insurance policy:

Tip 1: Make sure you understand your policy.

Before you file a claim, take the time to read your policy and understand what is covered. This will help you avoid any surprises down the road.

Tip 2: File your claim promptly.

The sooner you file your claim, the sooner your insurance company can start processing it. This will help you get your vehicle repaired or replaced as quickly as possible.

Tip 3: Be prepared to provide documentation.

When you file a claim, your insurance company will likely ask you to provide documentation to support your claim. This may include photos of the damage, a police report, or a repair estimate.

Tip 4: Be honest with your insurance company.

It is important to be honest with your insurance company about the circumstances of your accident or other covered event. This will help your insurance company process your claim quickly and fairly.

Tip 5: Be patient.

It can take time for your insurance company to process your claim. Be patient and understanding, and do not hesitate to contact your insurance company if you have any questions.

By following these tips, you can help ensure that you get the most out of your comprehensive insurance policy.

Summary of key takeaways:

- Understand your policy.

- File your claim promptly.

- Be prepared to provide documentation.

- Be honest with your insurance company.

- Be patient.

Asuransi comprehensive artinya comprehensive insurance provides comprehensive coverage for your vehicle. By following these tips, you can help ensure that you get the most out of your comprehensive insurance policy.

Next: Benefits of Comprehensive Insurance

Kesimpulan

Asuransi comprehensive artinya comprehensive insurance provides comprehensive coverage for your vehicle, regardless of who is at fault for an accident. It covers a wide range of events, including accidents, theft, vandalism, and natural disasters. Comprehensive insurance can help you to protect your financial investment in your vehicle and give you peace of mind.

If you are looking for a way to protect your vehicle and your finances, then comprehensive insurance is a good option for you. By following the tips in this article, you can help ensure that you get the most out of your comprehensive insurance policy.