Asuransi dibayar dimuka termasuk debit atau kredit refers to the accounting treatment of prepaid insurance premiums. When an insurance policy is purchased and the premium is paid in advance, the payment is initially recorded as a debit to the Prepaid Insurance asset account and a credit to the Cash asset account. As time passes and the insurance coverage is used up, the Prepaid Insurance asset account is gradually reduced (debited) and the Insurance Expense account is increased (credited) to reflect the expired portion of the insurance coverage.

Recording prepaid insurance premiums as a debit to an asset account and a credit to a liability account ensures that the insurance expense is recognized over the period of time that the coverage is in effect. This matches the expense with the related revenue and provides a more accurate picture of the company’s financial performance.

The proper accounting treatment of prepaid insurance premiums is important for several reasons. First, it ensures that the company’s financial statements are accurate and reliable. Second, it helps the company to manage its cash flow more effectively. By prepaying insurance premiums, the company can avoid having to make large payments all at once, which can help to smooth out its cash flow.

Asuransi dibayar dimuka termasuk debit atau kredit

When an insurance policy is purchased and the premium is paid in advance, the payment is initially recorded as a debit to the Prepaid Insurance asset account and a credit to the Cash asset account. As time passes and the insurance coverage is used up, the Prepaid Insurance asset account is gradually reduced (debited) and the Insurance Expense account is increased (credited) to reflect the expired portion of the insurance coverage.

- Definition: Prepaid insurance is an asset that represents the unused portion of an insurance policy.

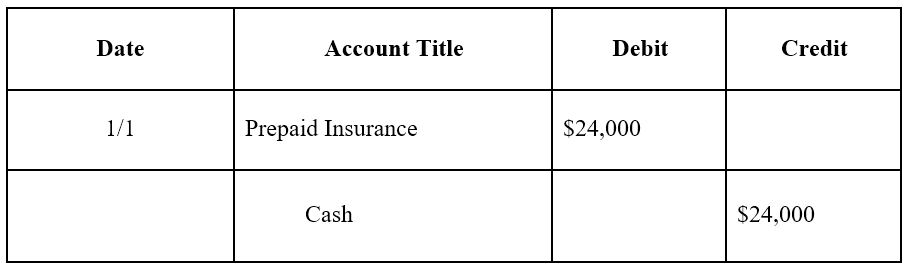

- Recording: Prepaid insurance is initially recorded as a debit to the Prepaid Insurance asset account and a credit to the Cash asset account.

- Expense recognition: As the insurance coverage is used up, the Prepaid Insurance asset account is debited and the Insurance Expense account is credited.

- Matching principle: Recording prepaid insurance premiums as a debit to an asset account and a credit to a liability account ensures that the insurance expense is recognized over the period of time that the coverage is in effect.

- Financial statement presentation: Prepaid insurance is reported on the balance sheet as a current asset.

- Cash flow management: By prepaying insurance premiums, a company can avoid having to make large payments all at once, which can help to smooth out its cash flow.

The proper accounting treatment of prepaid insurance premiums is important for several reasons. First, it ensures that the company’s financial statements are accurate and reliable. Second, it helps the company to manage its cash flow more effectively. Third, it provides a more accurate picture of the company’s financial performance by matching the insurance expense with the related revenue.

Definition

Prepaid insurance is an important component of “asuransi dibayar dimuka termasuk debit atau kredit” because it represents the unused portion of an insurance policy that has been paid for in advance. This is important because it allows companies to spread the cost of insurance over the period of time that the coverage is in effect, rather than having to pay for the entire policy upfront. This can help to smooth out a company’s cash flow and avoid large, unexpected expenses.

For example, a company that purchases a one-year insurance policy for $1,200 would initially record the payment as a debit to the Prepaid Insurance asset account and a credit to the Cash asset account. As the insurance coverage is used up over the course of the year, the Prepaid Insurance asset account would be gradually reduced (debited) and the Insurance Expense account would be increased (credited) to reflect the expired portion of the coverage. This would ensure that the insurance expense is recognized over the period of time that the coverage is in effect, matching the expense with the related revenue.

Understanding the connection between prepaid insurance and “asuransi dibayar dimuka termasuk debit atau kredit” is important for several reasons. First, it helps companies to accurately track their insurance expenses. Second, it helps companies to manage their cash flow more effectively. Third, it provides a more accurate picture of the company’s financial performance by matching the insurance expense with the related revenue.

Recording

This accounting entry is the foundation of “asuransi dibayar dimuka termasuk debit atau kredit” because it establishes the initial recording of the prepaid insurance premium. Prepaid insurance is an asset that represents the unused portion of an insurance policy that has been paid for in advance, and recording it as a debit to the Prepaid Insurance asset account increases the company’s assets.

- Recognition of the asset: Debit to the Prepaid Insurance account appropriately recognizes the company’s ownership of the prepaid insurance policy and the future economic benefits it represents.

- Matching principle: By initially recording the premium as an asset, the company can allocate the insurance expense over the period of the policy, matching the expense with the related revenue.

- Financial statement presentation: Recording the prepaid insurance as an asset ensures its proper presentation on the balance sheet, providing transparency and accuracy in financial reporting.

Understanding the connection between this accounting entry and “asuransi dibayar dimuka termasuk debit atau kredit” is crucial because it sets the stage for the subsequent recognition of insurance expense as the policy is used. As the insurance coverage expires, the Prepaid Insurance asset account is reduced (debited), and the Insurance Expense account is increased (credited), ensuring that the expense is recognized in the appropriate accounting period.

Expense recognition

The expense recognition aspect of “asuransi dibayar dimuka termasuk debit atau kredit” is crucial because it governs the recording of insurance expense over the policy period. The accounting treatment aligns with the matching principle, ensuring that expenses are recognized in the same period as the related revenue.

- Systematic expense allocation: This accounting practice ensures that the cost of insurance is spread evenly over the policy period, matching the expense with the gradual consumption of insurance coverage.

- Accurate financial reporting: By debiting the Prepaid Insurance asset account and crediting the Insurance Expense account, the financial statements accurately reflect the portion of the insurance premium that has been used and the remaining prepaid amount.

- Tax implications: The recognition of insurance expense in accordance with GAAP or other applicable accounting standards can have implications for tax purposes, affecting a company’s tax liability.

- Internal control: The expense recognition process provides an internal control mechanism, ensuring that insurance costs are properly accounted for and monitored, reducing the risk of errors or fraud.

Understanding the connection between expense recognition and “asuransi dibayar dimuka termasuk debit atau kredit” is vital for several reasons. First, it promotes accurate and consistent financial reporting. Second, it facilitates effective management of insurance costs. Third, it ensures compliance with accounting standards and tax regulations. Overall, the proper recognition of insurance expense contributes to the reliability and transparency of a company’s financial statements.

Matching principle

The matching principle is a fundamental accounting concept that requires expenses to be recognized in the same period as the related revenue. This principle ensures that a company’s financial statements accurately reflect its financial performance and position.

In the case of prepaid insurance, the matching principle dictates that the insurance expense should be recognized over the period of time that the coverage is in effect. This is because the prepaid insurance premium represents a payment for future insurance coverage. By debiting the Prepaid Insurance asset account and crediting the Cash asset account, the company is initially recognizing the asset (prepaid insurance) and deferring the recognition of the expense until the coverage is used.

As the insurance coverage is used up, the Prepaid Insurance asset account is gradually reduced (debited) and the Insurance Expense account is increased (credited) to reflect the expired portion of the coverage. This ensures that the insurance expense is recognized in the same period as the related revenue, providing a more accurate picture of the company’s financial performance.

The matching principle is an important component of “asuransi dibayar dimuka termasuk debit atau kredit” because it ensures that the insurance expense is recognized over the period of time that the coverage is in effect. This results in more accurate financial statements and a better understanding of the company’s financial performance.

Financial statement presentation

The financial statement presentation of prepaid insurance is an important component of “asuransi dibayar dimuka termasuk debit atau kredit” because it provides a clear and concise picture of the company’s financial health. Prepaid insurance is reported on the balance sheet as a current asset, which means that it is an asset that is expected to be converted into cash within one year. This is important because it gives users of the financial statements a clear understanding of the company’s liquidity and solvency.

For example, a company that has a large amount of prepaid insurance on its balance sheet is likely to be in a better financial position than a company that has a small amount of prepaid insurance. This is because the company with a large amount of prepaid insurance has more cash on hand and is less likely to experience financial difficulties in the near future.

Understanding the connection between the financial statement presentation of prepaid insurance and “asuransi dibayar dimuka termasuk debit atau kredit” is important for several reasons:

- It provides a clear and concise picture of the company’s financial health.

- It helps users of the financial statements to assess the company’s liquidity and solvency.

- It can be used to make informed investment decisions.

Cash flow management

The connection between “Cash flow management: By prepaying insurance premiums, a company can avoid having to make large payments all at once, which can help to smooth out its cash flow.” and “asuransi dibayar dimuka termasuk debit atau kredit” lies in the concept of managing and forecasting cash flow. Prepaid insurance is an important component of cash flow management because it allows a company to spread the cost of insurance over the period of time that the coverage is in effect, rather than having to pay for the entire policy upfront.

This can be especially beneficial for companies that have seasonal fluctuations in their revenue or that are experiencing financial difficulties. By prepaying insurance premiums, a company can avoid having to make large payments during periods of low revenue or financial stress. This can help to smooth out the company’s cash flow and avoid disruptions in its operations.

For example, a company that has a large insurance premium due in January may choose to prepay the premium in December instead. This would allow the company to spread the cost of the insurance over two months, rather than having to make one large payment in January. This can help to improve the company’s cash flow and avoid financial difficulties.

Understanding the connection between cash flow management and “asuransi dibayar dimuka termasuk debit atau kredit” is important for several reasons:

- It helps companies to manage their cash flow more effectively.

- It can help companies to avoid financial difficulties.

- It can help companies to make informed decisions about their insurance coverage.

Overall, the connection between cash flow management and “asuransi dibayar dimuka termasuk debit atau kredit” is an important one that can help companies to improve their financial performance.

FAQs on “Asuransi Dibayar Dimuka Termasuk Debit atau Kredit”

This section addresses common questions and misconceptions surrounding the accounting treatment of prepaid insurance premiums.

Question 1: What is the initial accounting entry for prepaid insurance?

Answer: The initial accounting entry is a debit to the Prepaid Insurance asset account and a credit to the Cash asset account.

Question 2: How is prepaid insurance expense recognized over the policy period?

Answer: Prepaid insurance expense is recognized as the insurance coverage is used up. This is done by debiting the Prepaid Insurance asset account and crediting the Insurance Expense account.

Question 3: Why is it important to record prepaid insurance as an asset initially?

Answer: Recording prepaid insurance as an asset initially allows the company to spread the cost of insurance over the period of time that the coverage is in effect, rather than having to expense the entire premium upfront. This provides a more accurate picture of the company’s financial performance.

Question 4: How does prepaid insurance affect a company’s cash flow?

Answer: By prepaying insurance premiums, a company can avoid having to make large payments all at once. This can help to smooth out the company’s cash flow and avoid financial difficulties.

Question 5: What are the implications of not recording prepaid insurance correctly?

Answer: Not recording prepaid insurance correctly can lead to inaccurate financial statements, which can mislead users of the financial statements and make it difficult to make informed decisions.

Question 6: Where is prepaid insurance reported on the balance sheet?

Answer: Prepaid insurance is reported on the balance sheet as a current asset.

Understanding the proper accounting treatment of prepaid insurance is important for companies to ensure accurate financial reporting and effective cash flow management.

Transition to the next article section…

Tips on “Asuransi Dibayar Dimuka Termasuk Debit atau Kredit”

Properly accounting for prepaid insurance premiums is crucial for accurate financial reporting and effective cash flow management. Here are some tips to effectively manage prepaid insurance:

Tip 1: Understand the Matching Principle

The matching principle requires that expenses be recognized in the same period as the related revenue. For prepaid insurance, this means recognizing the expense over the period of time that the coverage is in effect.

Tip 2: Establish a Clear Policy for Recording Prepaid Insurance

Develop a clear policy for recording prepaid insurance premiums. This policy should include guidelines on when to record the premium as an asset, how to allocate the cost over the policy period, and how to recognize the expense.

Tip 3: Use a Prepaid Insurance Schedule

A prepaid insurance schedule can help you to keep track of your prepaid insurance premiums and the related expenses. This schedule should include the following information: policy number, policy start and end dates, premium amount, and the amount of the premium that has been expensed to date.

Tip 4: Review Your Prepaid Insurance Regularly

Regularly review your prepaid insurance to ensure that it is being recorded and expensed correctly. This review should include verifying that the prepaid insurance balance on the balance sheet matches the supporting documentation.

Tip 5: Consult with a Professional

If you are unsure about how to account for prepaid insurance, consult with a professional accountant or tax advisor. They can help you to develop a plan that meets your specific needs.

By following these tips, you can ensure that your company is properly accounting for prepaid insurance premiums. This will lead to more accurate financial statements and better cash flow management.

Conclusion:

Understanding and correctly applying the accounting treatment of prepaid insurance is essential for businesses to maintain accurate financial records, optimize cash flow, and make informed financial decisions.

Conclusion

The accounting treatment of prepaid insurance premiums, commonly referred to as “asuransi dibayar dimuka termasuk debit atau kredit,” is a critical aspect of financial reporting and cash flow management. By understanding and correctly applying the relevant accounting principles, businesses can ensure accurate financial statements, optimize their cash flow, and make informed financial decisions.

Prepaid insurance premiums are initially recorded as an asset, recognizing the future economic benefits of the insurance coverage. Over the policy period, the prepaid insurance asset is gradually reduced, and the corresponding insurance expense is recognized. This systematic allocation of the insurance cost ensures a proper matching of expenses to revenue.

Effective management of prepaid insurance requires a clear understanding of the matching principle, the establishment of a sound recording policy, and regular review of the prepaid insurance balance. By adhering to these best practices, businesses can maintain accurate financial records, avoid cash flow disruptions, and enhance their overall financial performance.