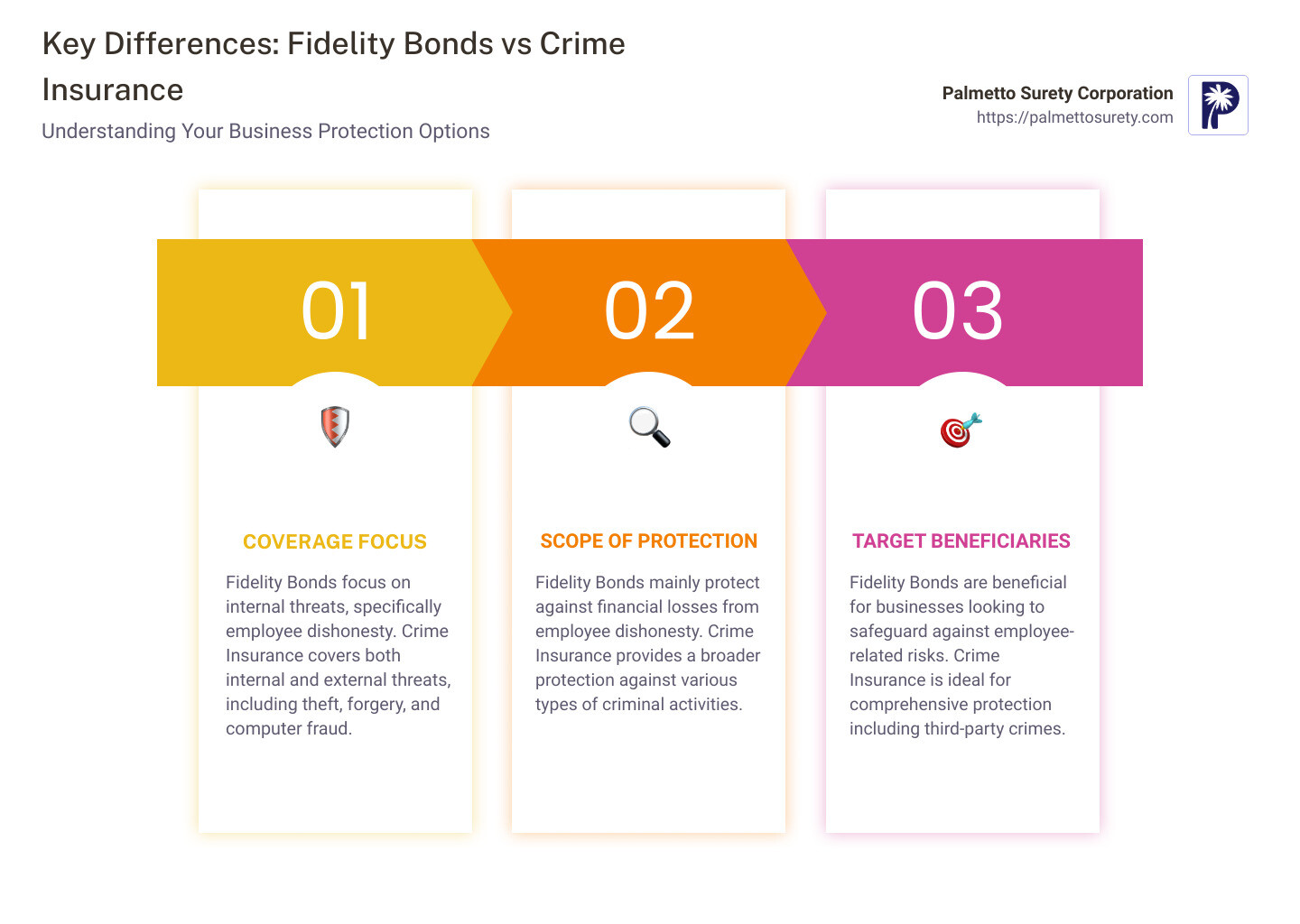

Fidelity insurance, also known as a fidelity bond, is a type of insurance that protects businesses from financial losses caused by employee theft or fraud. It covers losses resulting from dishonest acts by employees, such as embezzlement, forgery, and fraudulent expense claims.

Fidelity insurance is an important protection for businesses of all sizes. Employee theft and fraud can be a significant financial risk, and fidelity insurance can help to mitigate this risk. It can also help to protect businesses from the reputational damage that can result from employee dishonesty.

There are a number of different types of fidelity insurance policies available. The type of policy that is right for a particular business will depend on the size of the business, the industry in which it operates, and the level of risk that it faces.

Fidelity Insurance

Fidelity insurance, also known as a fidelity bond, is an important type of insurance that protects businesses from financial losses caused by employee theft or fraud. Here are six key aspects of fidelity insurance:

- Coverage: Fidelity insurance covers losses resulting from dishonest acts by employees, such as embezzlement, forgery, and fraudulent expense claims.

- Importance: Fidelity insurance is an important protection for businesses of all sizes, as employee theft and fraud can be a significant financial risk.

- Types: There are different types of fidelity insurance policies available, tailored to the size, industry, and risk level of a particular business.

- Benefits: Fidelity insurance provides financial protection, helps mitigate risk, and safeguards a business’s reputation.

- Considerations: When choosing a fidelity insurance policy, businesses should consider factors such as coverage limits, deductibles, and exclusions.

- Claims: In the event of a loss, businesses should promptly report the claim to their insurance provider and provide supporting documentation.

These aspects highlight the importance of fidelity insurance as a crucial risk management tool for businesses. By understanding the coverage, benefits, and considerations involved, businesses can make informed decisions to protect themselves from the financial consequences of employee dishonesty.

Coverage

This aspect of fidelity insurance is directly connected to the definition of “asuransi fidelity adalah,” which refers to insurance that protects businesses from financial losses caused by employee theft or fraud. The coverage provided by fidelity insurance encompasses various dishonest acts, including embezzlement, forgery, and fraudulent expense claims, thereby aligning with the core purpose of “asuransi fidelity adalah.”

- Protection against Embezzlement: Embezzlement involves the misappropriation of funds or property by an employee entrusted with their handling. Fidelity insurance coverage extends to such acts, safeguarding businesses from financial losses akibat embezzlement.

- Coverage for Forgery: Forgery refers to the fraudulent imitation of signatures or documents. Fidelity insurance provides protection against financial losses incurred due to forged checks, contracts, or other documents.

- Reimbursement for Fraudulent Expense Claims: Employees may attempt to defraud businesses by submitting false or inflated expense claims. Fidelity insurance coverage includes reimbursement for such fraudulent claims, mitigating the financial impact on businesses.

- Comprehensive Protection: The coverage provided by fidelity insurance is comprehensive, encompassing a wide range of dishonest acts committed by employees. This comprehensive protection aligns with the primary objective of “asuransi fidelity adalah,” which is to safeguard businesses from financial losses resulting from employee dishonesty.

In conclusion, the aspect of coverage in fidelity insurance is directly linked to the definition of “asuransi fidelity adalah.” By providing comprehensive protection against dishonest acts such as embezzlement, forgery, and fraudulent expense claims, fidelity insurance fulfills its primary purpose of safeguarding businesses from financial losses caused by employee theft or fraud.

Importance

This aspect of fidelity insurance is directly connected to the definition of “asuransi fidelity adalah,” which refers to insurance that protects businesses from financial losses caused by employee theft or fraud. The importance of fidelity insurance is underscored by the significant financial risk posed by employee theft and fraud, making it a crucial protection for businesses of all sizes.

- Protection against Financial Losses: Employee theft and fraud can result in substantial financial losses for businesses. Fidelity insurance provides a safety net, reimbursing businesses for losses incurred due to dishonest acts by employees.

- Mitigation of Risk: Fidelity insurance acts as a risk management tool, mitigating the financial impact of employee dishonesty. By transferring the risk to an insurance provider, businesses can safeguard their financial stability.

- Safeguarding Business Integrity: Employee theft and fraud can damage a business’s reputation and integrity. Fidelity insurance helps protect businesses from the reputational damage associated with such dishonest acts.

- Legal Compliance: In some jurisdictions, businesses may be legally required to carry fidelity insurance to protect against employee dishonesty. Fidelity insurance ensures compliance with such legal requirements.

In conclusion, the importance of fidelity insurance is deeply intertwined with the definition of “asuransi fidelity adalah.” By providing protection against financial losses, mitigating risk, safeguarding business integrity, and ensuring legal compliance, fidelity insurance plays a vital role in safeguarding businesses from the significant financial risk posed by employee theft and fraud.

Types

This aspect of fidelity insurance is directly connected to the definition of “asuransi fidelity adalah,” which refers to insurance that protects businesses from financial losses caused by employee theft or fraud. The different types of fidelity insurance policies available reflect the diverse needs and risk profiles of businesses.

- Customized Coverage: Fidelity insurance policies can be tailored to the specific risks faced by a particular business, considering its size, industry, and risk level. This customization ensures that businesses receive appropriate coverage for their unique circumstances.

- Industry-Specific Policies: Different industries have unique risks and vulnerabilities. Fidelity insurance policies can be designed to address the specific needs of various industries, such as financial institutions, healthcare providers, and retail businesses.

- Tailored Limits and Deductibles: The limits of coverage and deductibles can be adjusted to align with the risk tolerance and financial capacity of a business. This flexibility allows businesses to optimize their insurance protection based on their individual requirements.

- Comprehensive and Specialized Policies: Fidelity insurance policies can range from comprehensive coverage for a wide range of employee dishonesty acts to specialized policies that focus on specific risks, such as cyber fraud or employee theft of intellectual property.

In conclusion, the different types of fidelity insurance policies available underscore the adaptability and relevance of “asuransi fidelity adalah.” By tailoring coverage to the size, industry, and risk level of a particular business, fidelity insurance provides customized protection against the diverse risks of employee theft and fraud.

Benefits

The benefits of fidelity insurance are directly connected to the definition of “asuransi fidelity adalah,” which refers to insurance that protects businesses from financial losses caused by employee theft or fraud. The benefits of fidelity insurance underscore its value as a risk management tool for businesses.

- Financial Protection: Fidelity insurance provides a financial safety net for businesses, reimbursing them for losses incurred due to employee dishonesty. This financial protection helps businesses maintain their financial stability and continue their operations without significant disruption.

- Risk Mitigation: Fidelity insurance acts as a risk mitigation tool, reducing the financial impact of employee theft and fraud on businesses. By transferring the risk to an insurance provider, businesses can safeguard their financial well-being.

- Safeguarding Reputation: Employee theft and fraud can damage a business’s reputation and erode customer trust. Fidelity insurance helps businesses protect their reputation by providing financial coverage for losses caused by dishonest employees.

The benefits of fidelity insurance are crucial for businesses of all sizes. By providing financial protection, mitigating risk, and safeguarding reputation, fidelity insurance enables businesses to operate with greater confidence and security.

Considerations

“Asuransi fidelity adalah” refers to insurance that protects businesses from financial losses caused by employee theft or fraud. When choosing a fidelity insurance policy, businesses should carefully consider several factors to ensure adequate protection and optimize their insurance coverage. These factors include coverage limits, deductibles, and exclusions:

- Coverage Limits: Coverage limits determine the maximum amount an insurance provider will pay for covered losses. Businesses should assess their potential exposure to employee dishonesty and select a policy with coverage limits that align with their risk profile.

- Deductibles: Deductibles represent the amount a business must pay out-of-pocket before insurance coverage takes effect. Businesses should consider their financial capacity and risk tolerance when determining an appropriate deductible.

- Exclusions: Exclusions specify circumstances or situations not covered by the insurance policy. Businesses should carefully review exclusions to ensure they understand the scope of coverage provided by their policy.

By carefully considering these factors, businesses can make informed decisions when choosing a fidelity insurance policy. Adequate coverage limits provide sufficient financial protection, while appropriate deductibles balance cost and coverage. Understanding exclusions helps businesses avoid unexpected gaps in their insurance coverage.

Considering these factors aligns with the principles of “asuransi fidelity adalah” by ensuring that businesses have the necessary protection against employee theft or fraud. Fidelity insurance serves as a risk management tool, and careful consideration of coverage limits, deductibles, and exclusions allows businesses to tailor their insurance coverage to their specific needs and risk profile.

Claims

The aspect of claims in fidelity insurance is directly connected to the definition of “asuransi fidelity adalah,” which refers to insurance that protects businesses from financial losses caused by employee theft or fraud. Claims are a crucial component of fidelity insurance, as they enable businesses to recover losses incurred due to employee dishonesty.

When a loss occurs, prompt reporting and submission of supporting documentation are essential for a successful claim. By promptly reporting the claim, businesses can initiate the investigation process and provide the insurance provider with timely information. Supporting documentation, such as financial records and witness statements, helps substantiate the claim and supports the business’s request for reimbursement.

The claims process is an integral part of fidelity insurance, as it allows businesses to access the financial protection provided by the policy. Effective claims handling ensures that businesses can recover their losses and continue their operations without significant disruption. Therefore, understanding the claims process and adhering to the reporting requirements are crucial for businesses to maximize the benefits of their fidelity insurance coverage.

Frequently Asked Questions about Fidelity Insurance (“Asuransi Fidelity Adalah”)

This section addresses frequently asked questions (FAQs) about fidelity insurance, providing clear and concise answers to common concerns and misconceptions. Understanding these FAQs can help businesses make informed decisions about protecting themselves against employee theft or fraud.

Question 1: What is fidelity insurance and what does it cover?

Fidelity insurance, also known as a fidelity bond, is a type of insurance that protects businesses from financial losses caused by employee theft or fraud. It covers dishonest acts such as embezzlement, forgery, and fraudulent expense claims.

Question 2: Why is fidelity insurance important for businesses?

Fidelity insurance is important because employee theft and fraud can pose a significant financial risk to businesses. It provides a safety net, reimbursing businesses for losses incurred due to dishonest employee activities.

Question 3: What types of fidelity insurance policies are available?

Different types of fidelity insurance policies are available, tailored to the size, industry, and risk level of a particular business. These policies can range from comprehensive coverage to specialized policies that focus on specific risks, such as cyber fraud or employee theft of intellectual property.

Question 4: What are the benefits of fidelity insurance?

Fidelity insurance offers several benefits, including financial protection against losses caused by employee dishonesty, risk mitigation by transferring the risk to an insurance provider, and safeguarding a business’s reputation by providing coverage for dishonest acts.

Question 5: How do I choose the right fidelity insurance policy for my business?

When choosing a fidelity insurance policy, businesses should consider factors such as coverage limits, deductibles, and exclusions. It’s important to assess the potential exposure to employee dishonesty and select a policy that aligns with the business’s risk profile.

Question 6: What should businesses do in the event of a loss?

In the event of a loss, businesses should promptly report the claim to their insurance provider and provide supporting documentation. Prompt reporting and submission of supporting documentation are crucial for a successful claim and recovery of losses.

Summary: Understanding the FAQs about fidelity insurance helps businesses recognize its importance, choose the right policy, and navigate the claims process effectively. Fidelity insurance serves as a valuable risk management tool, protecting businesses from the financial consequences of employee dishonesty.

Transition: For further insights into fidelity insurance, explore the following resources…

Fidelity Insurance Tips

Fidelity insurance, also known as a fidelity bond, is an essential risk management tool for businesses seeking to protect themselves from financial losses caused by employee theft or fraud. Here are five valuable tips to consider:

Tip 1: Conduct Thorough Background Checks

Conducting thorough background checks on potential employees is crucial. Verify their employment history, education, and any potential red flags that may indicate a history of dishonesty.Tip 2: Implement Strong Internal Controls

Establish robust internal controls to minimize opportunities for employee fraud. Segregate duties, implement proper authorization procedures, and regularly review financial records for any anomalies.Tip 3: Provide Regular Training and Awareness

Educate employees about the importance of honesty and ethical conduct. Conduct regular training sessions to raise awareness about the consequences of employee dishonesty and the protections provided by fidelity insurance.Tip 4: Maintain Accurate and Up-to-Date Records

Keep meticulous financial records and supporting documentation to facilitate the investigation and resolution of any potential claims. Accurate records are essential for proving losses and recovering funds.Tip 5: Promptly Report Suspicious Activities

If suspicious activities or irregularities are detected, report them to the appropriate authorities and your insurance provider promptly. Early reporting can help mitigate losses and facilitate a smoother claims process.

Summary: By implementing these tips, businesses can strengthen their protection against employee dishonesty and maximize the benefits of fidelity insurance. These measures help deter fraud, minimize financial losses, and maintain the integrity of business operations.

Transition: For further guidance on fidelity insurance and effective risk management strategies, consult with an experienced insurance professional or refer to the resources provided below…

Fidelity Insurance

In conclusion, fidelity insurance, or “asuransi fidelity,” plays a pivotal role in protecting businesses from the detrimental financial consequences of employee theft or fraud. By providing comprehensive coverage against dishonest acts such as embezzlement, forgery, and fraudulent expense claims, fidelity insurance serves as a cornerstone of sound risk management practices.

Businesses of all sizes and industries should consider fidelity insurance as an essential investment in their financial well-being. The importance of safeguarding against employee dishonesty cannot be overstated, and fidelity insurance provides a reliable safety net in the event of such unfortunate occurrences. By implementing robust internal controls, conducting thorough background checks, and promptly reporting suspicious activities, businesses can further strengthen their defenses against fraud and maximize the benefits of their fidelity insurance policies.