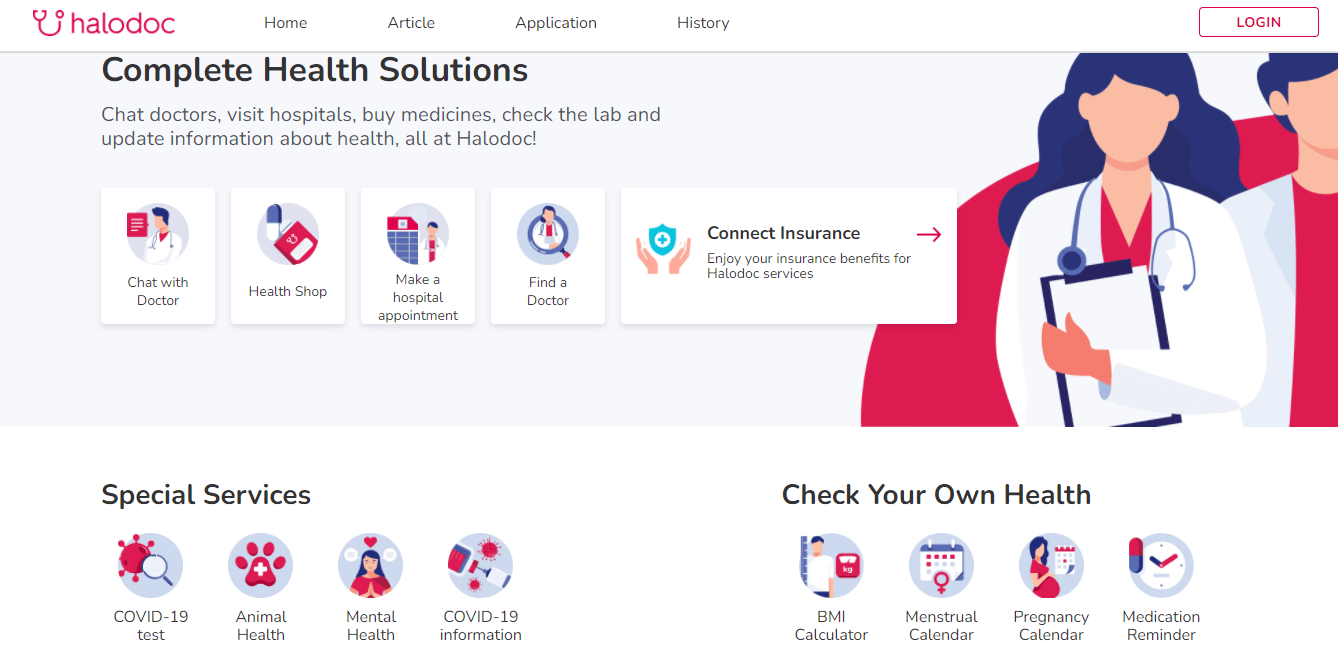

Asuransi Halodoc is a health insurance product offered by Halodoc, a leading Indonesian healthcare technology platform. It provides comprehensive coverage for a range of medical expenses, including hospitalization, outpatient care, and prescription drugs.

Asuransi Halodoc is designed to make healthcare more accessible and affordable for Indonesians. It offers flexible payment plans and a wide network of healthcare providers, making it easy for people to get the care they need. Asuransi Halodoc also provides 24/7 customer support, so policyholders can always get the help they need.

Asuransi Halodoc is a valuable tool for anyone looking to protect their health and financial well-being. It provides comprehensive coverage at an affordable price, and it makes it easy to get the care you need.

Asuransi Halodoc

Asuransi Halodoc is a health insurance product offered by Halodoc, a leading Indonesian healthcare technology platform. It provides comprehensive coverage for a range of medical expenses, including hospitalization, outpatient care, and prescription drugs.

- Affordable: Asuransi Halodoc offers flexible payment plans that make it easy for people to get the coverage they need.

- Accessible: Asuransi Halodoc has a wide network of healthcare providers, making it easy for people to get the care they need.

- Comprehensive: Asuransi Halodoc provides comprehensive coverage for a range of medical expenses, including hospitalization, outpatient care, and prescription drugs.

- Convenient: Asuransi Halodoc ofrece 24/7 customer support, so policyholders can always get the help they need.

- Reliable: Asuransi Halodoc is backed by Halodoc, a leading Indonesian healthcare technology platform.

- Peace of mind: Asuransi Halodoc provides peace of mind, knowing that you are protected against unexpected medical expenses.

These six key aspects make Asuransi Halodoc a valuable tool for anyone looking to protect their health and financial well-being. It provides comprehensive coverage at an affordable price, and it makes it easy to get the care you need.

Affordable

Asuransi Halodoc is an affordable health insurance product that offers flexible payment plans. This makes it easy for people to get the coverage they need, even if they have a limited budget. The flexible payment plans allow people to pay for their insurance in monthly installments, which makes it more manageable for many people.

The affordability of Asuransi Halodoc is one of its key benefits. It makes health insurance more accessible to people who may not have been able to afford it in the past. This is especially important in Indonesia, where many people do not have access to affordable health insurance.

The affordability of Asuransi Halodoc has a number of practical implications. For example, it can help people to avoid financial hardship in the event of a medical emergency. It can also help people to get the preventive care they need to stay healthy and avoid costly medical problems down the road.

Overall, the affordability of Asuransi Halodoc is a major benefit that makes it a valuable tool for people looking to protect their health and financial well-being.

Accessible

Asuransi Halodoc has a wide network of healthcare providers, making it easy for people to get the care they need. This is a major benefit, as it means that policyholders can choose from a variety of providers to find the one that best meets their needs.

- Convenience: Asuransi Halodoc’s wide network of healthcare providers makes it convenient for people to get the care they need. Policyholders can choose from a variety of providers, including hospitals, clinics, and doctors.

- Choice: Asuransi Halodoc’s wide network of healthcare providers gives policyholders the choice to find the provider that best meets their needs. This is important, as different providers offer different services and specialties.

- Quality: Asuransi Halodoc’s wide network of healthcare providers includes some of the best hospitals and clinics in Indonesia. This means that policyholders can be confident that they are getting quality care.

- Affordability: Asuransi Halodoc’s wide network of healthcare providers includes a variety of affordable options. This makes it easy for people to find a plan that fits their budget.

Overall, Asuransi Halodoc’s wide network of healthcare providers is a major benefit that makes it a valuable tool for people looking to protect their health and financial well-being.

Comprehensive

Asuransi Halodoc is a comprehensive health insurance product that provides coverage for a wide range of medical expenses, including hospitalization, outpatient care, and prescription drugs. This makes it a valuable tool for people looking to protect their health and financial well-being.

- Hospitalization: Asuransi Halodoc provides coverage for hospitalization expenses, including room and board, surgery, and other medical care.

- Outpatient care: Asuransi Halodoc provides coverage for outpatient care, including doctor visits, laboratory tests, and X-rays.

- Prescription drugs: Asuransi Halodoc provides coverage for prescription drugs, including both generic and brand-name medications.

The comprehensive coverage of Asuransi Halodoc means that policyholders can be confident that they will be protected against a wide range of medical expenses. This can provide peace of mind and financial security in the event of a medical emergency.

Convenient

The convenient customer support offered by Asuransi Halodoc is a key component of its value proposition. Policyholders can get the help they need 24/7, which provides peace of mind and makes it easy to manage their health insurance.

There are a number of ways in which the convenient customer support of Asuransi Halodoc benefits policyholders. For example, policyholders can:

- Get help with filing claims

- Get answers to their questions about their coverage

- Find a doctor or hospital in their network

- Get help with managing their health insurance account

The convenient customer support of Asuransi Halodoc is also important for policyholders who need to get help with a medical emergency. Policyholders can call the customer support line 24/7 to get help with finding a doctor, getting to the hospital, or paying for medical care.

Overall, the convenient customer support of Asuransi Halodoc is a valuable benefit that makes it easy for policyholders to manage their health insurance and get the help they need when they need it.

Reliable

The reliability of Asuransi Halodoc is one of its key benefits. Asuransi Halodoc is backed by Halodoc, a leading Indonesian healthcare technology platform. Halodoc has a proven track record of providing quality healthcare services to Indonesians. It has a wide network of healthcare providers, including hospitals, clinics, and doctors. Halodoc also has a team of experienced customer support staff who are available 24/7 to help policyholders with any questions or problems they may have.

The reliability of Asuransi Halodoc is important for a number of reasons. First, it gives policyholders peace of mind knowing that they are protected by a reputable and experienced insurance company. Second, it ensures that policyholders will be able to get the care they need when they need it. Third, it helps to keep the cost of health insurance down, as Halodoc is able to use its scale to negotiate lower rates with healthcare providers.

Overall, the reliability of Asuransi Halodoc is a major benefit that makes it a valuable tool for people looking to protect their health and financial well-being.

Peace of mind

In today’s world, it is more important than ever to have peace of mind knowing that you are protected against unexpected medical expenses. Asuransi Halodoc provides this peace of mind by providing comprehensive health insurance coverage that can help you pay for medical expenses in the event of an accident or illness.

- Financial security: Asuransi Halodoc can help you avoid financial hardship in the event of a medical emergency. Without health insurance, you could be responsible for paying thousands of dollars in medical bills, which could put a serious strain on your finances.

- Access to quality care: Asuransi Halodoc gives you access to quality healthcare, regardless of your financial situation. With health insurance, you can see the doctor when you need to and get the treatment you need to stay healthy.

- Peace of mind: Knowing that you are protected against unexpected medical expenses can give you peace of mind. You can rest easy knowing that you and your family are covered in the event of a medical emergency.

If you are looking for peace of mind, Asuransi Halodoc is the perfect solution. Asuransi Halodoc provides comprehensive health insurance coverage that can protect you and your family from unexpected medical expenses.

Asuransi Halodoc FAQs

Asuransi Halodoc is a health insurance product offered by Halodoc, a leading Indonesian healthcare technology platform. It provides comprehensive coverage for a range of medical expenses, including hospitalization, outpatient care, and prescription drugs.

Question 1: What is Asuransi Halodoc?

Answer: Asuransi Halodoc is a comprehensive health insurance product offered by Halodoc, a leading Indonesian healthcare technology platform.

Question 2: What does Asuransi Halodoc cover?

Answer: Asuransi Halodoc provides comprehensive coverage for a range of medical expenses, including hospitalization, outpatient care, and prescription drugs.

Question 3: How much does Asuransi Halodoc cost?

Answer: Asuransi Halodoc offers flexible payment plans that make it easy for people to get the coverage they need.

Question 4: Where can I get Asuransi Halodoc?

Answer: Asuransi Halodoc is available through Halodoc’s website and mobile app.

Question 5: How do I file a claim with Asuransi Halodoc?

Answer: You can file a claim with Asuransi Halodoc through the Halodoc website or mobile app.

Question 6: What are the benefits of Asuransi Halodoc?

Answer: Asuransi Halodoc offers a number of benefits, including comprehensive coverage, affordable prices, and convenient access to care.

Summary of key takeaways or final thought:

Asuransi Halodoc is a valuable tool for anyone looking to protect their health and financial well-being. It provides comprehensive coverage at an affordable price, and it makes it easy to get the care you need.

Transition to the next article section:

For more information about Asuransi Halodoc, please visit the Halodoc website or mobile app.

Tips on Choosing the Right Health Insurance Plan

Choosing the right health insurance plan is an important decision that can have a big impact on your finances and your health. Here are a few tips to help you make the best decision for your needs.

Tip 1: Consider your needs. What kind of coverage do you need? Do you have any pre-existing conditions? Do you take any prescription medications? Consider your current health status and your future health goals when choosing a plan.

Tip 2: Compare plans. Don’t just go with the first plan you find. Take the time to compare different plans and find one that meets your needs and budget.

Tip 3: Read the fine print. Make sure you understand the terms and conditions of your plan before you sign up. Pay attention to the deductible, co-pays, and out-of-pocket maximums.

Tip 4: Talk to a professional. If you’re not sure which plan is right for you, talk to a health insurance agent. They can help you compare plans and find one that meets your needs.

Tip 5: Don’t be afraid to switch plans. If you’re not happy with your current plan, you can switch to a new plan during the open enrollment period.

By following these tips, you can choose the right health insurance plan for your needs and budget. Health insurance is an important investment in your health and your future.

For more information on choosing the right health insurance plan, please visit the Asuransi Halodoc website or mobile app.

Kesimpulan

Asuransi Halodoc merupakan produk asuransi kesehatan yang komprehensif dan terjangkau, memberikan ketenangan pikiran dan perlindungan finansial terhadap biaya medis tak terduga.

Dengan manfaatnya yang beragam, termasuk cakupan komprehensif, akses mudah ke layanan kesehatan, dan dukungan pelanggan 24/7, Asuransi Halodoc menjadi pilihan ideal bagi siapa saja yang mengutamakan kesehatan dan kesejahteraan finansial mereka.