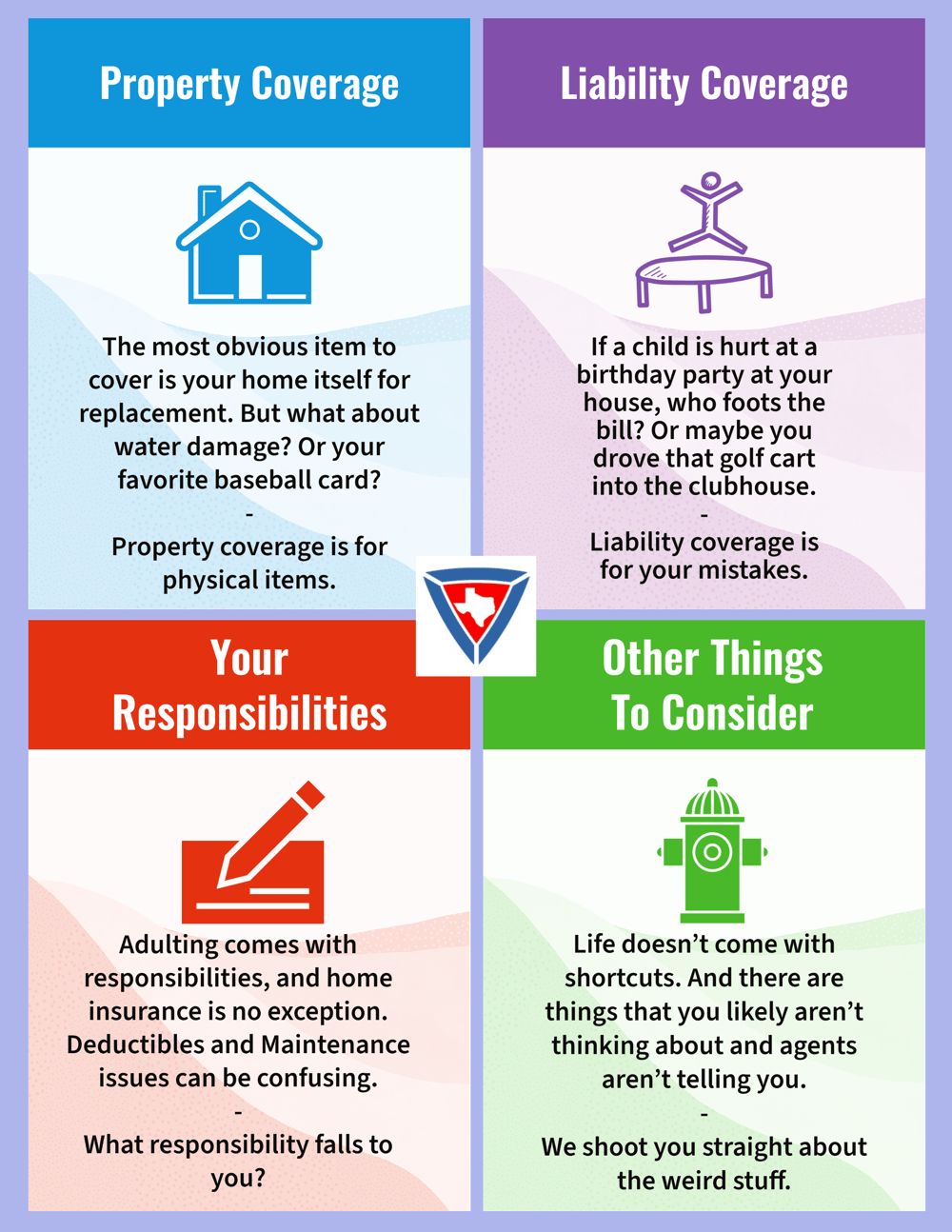

Property insurance, also known as homeowners insurance or renters insurance, is a type of insurance that provides financial protection against losses and damages to an individual’s property. It covers both the structure of the property and its contents, such as furniture, appliances, and personal belongings.

Property insurance is essential for protecting one’s financial well-being in the event of unexpected events such as fires, natural disasters, theft, or vandalism. It provides peace of mind knowing that the costs associated with repairing or replacing damaged property will be covered. Additionally, property insurance can provide liability coverage in case someone is injured on the property.

The history of property insurance dates back to the 17th century, when it was first introduced in England to protect against fire damage. Over time, property insurance has evolved to cover a wider range of risks and is now an essential component of personal finance for homeowners and renters alike.

Property Insurance

Property insurance is a crucial aspect of personal finance, providing protection against financial losses due to property damage or loss. Here are six key aspects to consider:

- Coverage: Property insurance typically covers the structure of the property, its contents, and additional living expenses if the property becomes uninhabitable.

- Risks: Property insurance protects against various risks, including fire, theft, vandalism, and natural disasters.

- Premiums: The cost of property insurance is determined by factors such as the value of the property, the location, and the level of coverage.

- Deductible: A deductible is the amount the policyholder pays out of pocket before the insurance coverage begins.

- Claims: In the event of a covered loss, the policyholder must file a claim with the insurance company to receive compensation.

- Exclusions: Property insurance policies may have certain exclusions, such as damage caused by floods or earthquakes.

Understanding these key aspects is essential for making informed decisions about property insurance coverage. By carefully considering the coverage, risks, premiums, deductibles, claims process, and exclusions, individuals can ensure that their property is adequately protected against financial losses.

Coverage

“Asuransi harta” or property insurance provides comprehensive coverage for various aspects of a property and its contents. The coverage typically includes:

- Structure of the property: This covers the physical structure of the property, including the walls, roof, foundation, and any attached structures such as garages or patios.

- Contents of the property: This covers personal belongings within the property, such as furniture, appliances, electronics, clothing, and valuables like jewelry or artwork.

- Additional living expenses: If the property becomes uninhabitable due to a covered loss, this coverage helps pay for additional living expenses, such as rent for a temporary residence, hotel accommodation, or meals.

Understanding the coverage provided by “asuransi harta” is essential for homeowners and renters to make informed decisions about their insurance needs. By ensuring adequate coverage, individuals can protect their financial well-being and minimize the impact of unexpected events on their property.

Risks

Asuransi harta, or property insurance, provides comprehensive protection against a wide range of risks that can damage or destroy property. These risks include:

- Fire: Fire is a major risk to property, and property insurance provides coverage for damage caused by fires, regardless of the cause.

- Theft: Theft is another common risk, and property insurance provides coverage for the loss of personal belongings due to theft.

- Vandalism: Vandalism can cause significant damage to property, and property insurance provides coverage for malicious damage caused by third parties.

- Natural disasters: Natural disasters, such as hurricanes, earthquakes, and floods, can cause extensive damage to property. Property insurance typically provides coverage for damage caused by natural disasters, subject to the specific terms of the policy.

Understanding the risks covered by property insurance is essential for property owners and renters alike. By ensuring adequate coverage, individuals can protect their financial well-being and minimize the impact of unexpected events on their property.

Premiums

The cost of property insurance, or “premi asuransi harta” in Indonesian, is influenced by several key factors that directly impact the level of risk and coverage provided by the insurance policy. These factors include:

- Value of the property: The higher the value of the property, the higher the insurance premiums will be. This is because the insurance company is assuming more risk by insuring a more valuable property.

- Location of the property: The location of the property also affects the insurance premiums. Properties located in areas with higher crime rates or natural disaster risks will typically have higher premiums.

- Level of coverage: The level of coverage chosen by the policyholder also impacts the insurance premiums. Higher levels of coverage, such as comprehensive coverage, will typically result in higher premiums.

Understanding the factors that affect property insurance premiums is essential for homeowners and renters alike. By carefully considering these factors, individuals can make informed decisions about their insurance coverage and ensure that they are adequately protected against financial losses in the event of a covered event.

For example, a homeowner living in an area with a low crime rate and low risk of natural disasters may opt for a lower level of coverage, resulting in lower insurance premiums. On the other hand, a homeowner living in an area with a high crime rate and high risk of natural disasters may opt for a higher level of coverage, resulting in higher insurance premiums.

Ultimately, the cost of property insurance is a reflection of the level of risk and coverage provided by the insurance policy. By understanding the factors that affect insurance premiums, individuals can make informed decisions about their insurance coverage and ensure that they are adequately protected against financial losses.

Deductible

In the context of “asuransi harta” or property insurance, the deductible plays a crucial role in determining the financial responsibility of the policyholder in the event of a covered loss. It represents the amount that the policyholder must pay towards the repair or replacement of damaged property before the insurance coverage kicks in.

The deductible serves several important functions. Firstly, it helps to reduce the cost of insurance premiums for policyholders. By agreeing to pay a portion of the claim out of pocket, policyholders can lower their overall insurance costs. Secondly, the deductible acts as a deterrent against filing frivolous or minor claims, as policyholders are less likely to file claims for small losses that they can afford to cover themselves.

When choosing a deductible, policyholders should carefully consider their financial situation and risk tolerance. A higher deductible will result in lower insurance premiums, but it also means that the policyholder will have to pay more out of pocket in the event of a claim. Conversely, a lower deductible will result in higher insurance premiums but less financial responsibility in the event of a claim.

Understanding the role and significance of the deductible in “asuransi harta” is essential for policyholders to make informed decisions about their insurance coverage. By carefully considering their financial situation and risk tolerance, policyholders can choose a deductible that meets their individual needs and provides adequate protection against financial losses.

Claims

Claims are an integral part of “asuransi harta” or property insurance, as they represent the process through which policyholders can seek compensation for covered losses. The claims process involves several key steps that policyholders should be familiar with to ensure a smooth and successful resolution:

- Reporting the loss: In the event of a covered loss, the policyholder must promptly notify the insurance company and report the details of the loss. This can typically be done by phone, email, or through the insurance company’s online portal.

- Filing a claim: Once the loss has been reported, the policyholder will need to file a formal claim with the insurance company. This typically involves completing a claim form and providing supporting documentation, such as photos of the damage and receipts for repairs or replacements.

- Assessment and investigation: The insurance company will then assign an adjuster to assess the damage and investigate the claim. The adjuster will visit the property to inspect the damage and gather additional information.

- Settlement: Once the investigation is complete, the insurance company will determine the amount of compensation to be paid to the policyholder. This amount will be based on the coverage limits of the policy and the extent of the damage.

Understanding the claims process is crucial for policyholders to receive timely and fair compensation for covered losses. By following the steps outlined above and providing accurate and complete information, policyholders can increase their chances of a successful claim settlement.

Exclusions

Exclusions in “asuransi harta” or property insurance policies play a significant role in defining the scope of coverage provided by the insurer. They outline specific events or circumstances that are not covered under the policy, ensuring clarity and fairness in the insurance contract. Understanding these exclusions is crucial for policyholders to avoid unexpected financial burdens in the event of a loss.

- Acts of God: Many property insurance policies exclude damage caused by certain natural disasters, such as floods, earthquakes, and hurricanes. These events are often considered unpredictable and catastrophic, and insurers may require separate riders or endorsements to provide coverage for them.

- War and Terrorism: Damage resulting from war, invasion, or acts of terrorism is typically excluded from standard property insurance policies. This exclusion reflects the high level of risk and potential for catastrophic losses associated with such events.

- Intentional Acts: Property insurance policies generally exclude damage caused intentionally by the policyholder or a related party. This exclusion aims to prevent fraudulent claims and ensure that the policyholder takes reasonable steps to protect their property.

- Wear and Tear: Gradual deterioration of property due to normal wear and tear is not covered by property insurance. This exclusion recognizes that property naturally ages and requires regular maintenance, which is the responsibility of the property owner.

Exclusions in “asuransi harta” serve to balance the need for comprehensive coverage with the practicalities of insurance. By carefully reviewing and understanding these exclusions, policyholders can make informed decisions about their insurance needs and ensure that their property is adequately protected against covered risks.

Frequently Asked Questions about “Asuransi Harta”

This section provides comprehensive answers to frequently asked questions regarding “asuransi harta” or property insurance, empowering individuals with the knowledge they need to make informed decisions about their coverage.

Question 1: What is covered under “asuransi harta”?

Asuransi harta typically covers the structure of the property, its contents, and additional living expenses if the property becomes uninhabitable due to a covered loss.

Question 2: What are the common risks covered by “asuransi harta”?

Property insurance generally provides coverage against risks such as fire, theft, vandalism, and natural disasters, subject to the specific terms of the policy.

Question 3: How is the cost of “asuransi harta” determined?

The cost of property insurance varies based on factors such as the value of the property, its location, and the level of coverage chosen by the policyholder.

Question 4: What is the purpose of a deductible in “asuransi harta”?

A deductible is the amount the policyholder pays out of pocket before the insurance coverage begins, and it serves to reduce insurance premiums and deter frivolous claims.

Question 5: How do I file a claim under “asuransi harta”?

In the event of a covered loss, policyholders should promptly notify the insurance company and file a formal claim, providing supporting documentation as required.

Question 6: Are there any exclusions to coverage under “asuransi harta”?

Yes, property insurance policies often exclude certain events or circumstances, such as damage caused by floods, earthquakes, or intentional acts.

Understanding these key aspects of “asuransi harta” is crucial for individuals seeking to protect their property and financial well-being. By carefully considering the coverage, risks, costs, and exclusions, policyholders can make informed decisions about their insurance needs and ensure adequate protection against unforeseen events.

For further information or personalized advice, consulting with an insurance professional is highly recommended.

Tips for Effective Property Insurance (“Asuransi Harta”)

Property insurance plays a vital role in protecting your property and financial well-being. Here are some valuable tips to optimize your insurance coverage:

Tip 1: Understand Your Coverage:Thoroughly review your insurance policy to understand the extent of coverage provided. Identify the types of risks covered, the limits of coverage, and any exclusions that may apply.Tip 2: Determine Your Replacement Cost:Calculate the cost of replacing your property and its contents to ensure adequate coverage. Consider factors like building materials, labor costs, and the value of your belongings.Tip 3: Choose the Right Deductible:Select a deductible that balances affordability with coverage needs. A higher deductible lowers premiums but increases your out-of-pocket expenses in the event of a claim.Tip 4: Document Your Belongings:Create an inventory of your belongings, including photographs or videos. Keep this documentation in a safe place outside your home for insurance purposes.Tip 5: Review Your Policy Regularly:As your property and circumstances change, review your insurance policy annually. Adjust coverage limits and deductibles as necessary to ensure continued adequate protection.Tip 6: Secure Your Property:Implement measures to minimize risks and prevent losses. Install security systems, maintain your property, and take steps to prevent accidents.Tip 7: Report Claims Promptly:In the event of a covered loss, promptly notify your insurance company and file a claim. Provide clear documentation and evidence to support your claim.Tip 8: Work with a Reputable Insurer:Choose an insurance company with a strong reputation for financial stability and customer service. They can provide expert guidance and ensure a smooth claims process.By following these tips, you can enhance the effectiveness of your property insurance (“asuransi harta”) and safeguard your property against unforeseen events.

Remember, understanding and optimizing your insurance coverage is crucial for protecting your financial well-being and ensuring peace of mind.

Conclusion

Property insurance, known as “asuransi harta” in Indonesian, plays a pivotal role in safeguarding your property and financial well-being. This article has explored the various aspects of property insurance, emphasizing its coverage, risks, costs, claims process, and exclusions. By understanding these key elements, you can make informed decisions about your insurance needs and ensure adequate protection against unforeseen events.

Remember, property insurance is not merely a financial transaction but an investment in your peace of mind. It provides a safety net against the uncertainties of life, giving you confidence in knowing that your property and belongings are protected. As you navigate the complexities of property ownership, embrace the significance of “asuransi harta” and take proactive steps to safeguard your valuable assets.