Life insurance, also known as “asuransi jiwa” in Indonesian, is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a sum of money to a designated beneficiary upon the policyholder’s death. The policyholder typically pays a premium to the insurance company in exchange for this coverage.

Life insurance serves a critical role in providing financial protection and peace of mind to individuals and their families. It ensures that a family can maintain their standard of living and cover expenses such as funeral costs, outstanding debts, and mortgage payments in the event of the policyholder’s untimely demise. Moreover, life insurance can serve as an investment vehicle, offering cash value accumulation and tax-deferred growth potential.

The history of life insurance dates back to the 14th century, with the first known policy issued in Italy in 1347. Since then, life insurance has evolved and gained widespread acceptance as a valuable financial planning tool. Today, it is an integral part of comprehensive financial strategies, providing a safety net and ensuring financial security for individuals, families, and businesses alike.

Life Insurance (Asuransi Jiwa)

Life insurance plays a crucial role in financial planning, providing peace of mind and protection for individuals and their families. Here are six key aspects of life insurance to consider:

- Coverage: The amount of financial protection provided to beneficiaries upon the policyholder’s death.

- Beneficiaries: The individuals or entities designated to receive the insurance payout.

- Premiums: The regular payments made by the policyholder to maintain the insurance coverage.

- Policy Term: The period of time for which the insurance coverage is valid.

- Riders: Optional add-ons to the policy that provide additional coverage, such as disability or accidental death benefits.

- Investment Component: Some life insurance policies offer a cash value component that accumulates over time, providing a potential investment opportunity.

These aspects are interconnected and play a vital role in determining the effectiveness of a life insurance policy. For example, the coverage amount should be sufficient to meet the financial needs of the beneficiaries, while the premiums should be affordable for the policyholder. The policy term should align with the individual’s financial goals and responsibilities, and riders can provide tailored protection against specific risks. Additionally, the investment component can offer long-term financial growth potential, supplementing the death benefit.

Coverage

In the context of “asuransi jiwa” (life insurance), coverage refers to the financial protection provided to beneficiaries upon the policyholder’s death. It is a crucial aspect of life insurance as it determines the level of financial support the beneficiaries will receive in the event of the policyholder’s untimely demise.

- Adequacy of Coverage: The coverage amount should be sufficient to meet the financial needs of the beneficiaries. This includes covering expenses such as funeral costs, outstanding debts, mortgage payments, and living expenses. Underinsurance can leave beneficiaries with a financial burden, while overinsurance can result in unnecessary premium payments.

- Beneficiary Designation: The policyholder should carefully consider who they designate as beneficiaries. Beneficiaries can be individuals, such as a spouse or children, or entities, such as a trust or charity. It is important to ensure that the beneficiaries are clearly identified and that their contact information is up-to-date.

- Impact on Premiums: The coverage amount directly affects the insurance premiums. Higher coverage amounts typically result in higher premiums, as the insurance company assumes greater risk. Policyholders should consider their budget and financial situation when determining the appropriate coverage level.

- Tax Implications: Life insurance proceeds are generally not subject to income tax, providing a tax-advantaged way to transfer wealth to beneficiaries. However, there may be tax implications if the policyholder retains ownership of the policy or if the proceeds are used for certain purposes.

Overall, the coverage amount in life insurance plays a critical role in ensuring that the beneficiaries have adequate financial protection in the event of the policyholder’s death. By carefully considering the factors discussed above, policyholders can make informed decisions about the coverage amount that best meets their needs and goals.

Beneficiaries

In the context of “asuransi jiwa” (life insurance), beneficiaries hold paramount importance as the individuals or entities legally entitled to receive the insurance payout upon the policyholder’s death. Their designation is a crucial component of life insurance, ensuring that the policyholder’s wishes are respected and their loved ones are financially protected.

The selection of beneficiaries is a thoughtful process that requires careful consideration. Policyholders should consider their financial dependents, such as spouses, children, or aging parents, and determine how the insurance payout can best support their future well-being. Beneficiaries can also be non-individuals, such as trusts, charities, or businesses, allowing policyholders to fulfill specific financial obligations or make meaningful contributions to causes they care about.

Understanding the role of beneficiaries in “asuransi jiwa” has practical implications. For instance, it emphasizes the importance of keeping beneficiary information up-to-date to ensure that the intended recipients receive the payout without delay or complications. It also highlights the need for clear communication between policyholders and beneficiaries to avoid any misunderstandings or disputes regarding the distribution of the insurance proceeds.

In summary, beneficiaries play a pivotal role in “asuransi jiwa” by ensuring that the policyholder’s financial legacy is distributed according to their wishes. Careful consideration and proper planning around beneficiary designation can provide peace of mind and financial security for the policyholder and their loved ones.

Premiums

In the realm of “asuransi jiwa” (life insurance), premiums play a fundamental role in upholding the financial covenant between the policyholder and the insurance provider. These regular payments serve as the cornerstone of life insurance, ensuring the continuity of coverage and the fulfillment of the policy’s promises.

- Determinant of Coverage: Premiums directly influence the extent of coverage provided by the life insurance policy. Higher premiums typically correspond to more comprehensive coverage, offering greater financial protection to the beneficiaries.

- Financial Planning: Premiums should be factored into the policyholder’s financial plan. Consistent and timely premium payments are essential to maintain the policy’s validity and prevent lapse, which could jeopardize the insurance coverage.

- Risk Assessment: Insurance companies evaluate various factors to determine the premium amount. These factors include the policyholder’s age, health, lifestyle habits, and the coverage amount.

- Investment Component: Some life insurance policies offer an investment component, where a portion of the premiums is invested in financial instruments. This can provide potential returns and cash value accumulation over time.

Understanding the significance of premiums in “asuransi jiwa” empowers policyholders to make informed decisions about their coverage needs and financial commitments. It underscores the importance of regular premium payments to ensure uninterrupted protection for their loved ones and the realization of their financial goals.

Policy Term

In the realm of “asuransi jiwa” (life insurance), the policy term holds immense significance, defining the duration for which the insurance coverage remains active. It serves as the temporal boundary within which the insurer’s promise of financial protection extends, safeguarding the policyholder’s loved ones against unforeseen events.

The policy term is a crucial component of “asuransi jiwa” as it dictates the period during which the beneficiaries are eligible to receive the insurance payout upon the policyholder’s demise. It aligns with the policyholder’s financial goals and life stage, ensuring that coverage is maintained throughout critical periods, such as raising a family or accumulating wealth.

For instance, a policyholder with young children may opt for a policy term that extends until their children reach financial independence. This ensures that the insurance payout can be utilized for their education, upbringing, or other essential expenses in the event of the policyholder’s untimely passing.

Understanding the policy term in “asuransi jiwa” empowers policyholders to make informed decisions about the duration of their coverage and align it with their evolving needs and responsibilities. It emphasizes the importance of carefully considering the policy term to ensure uninterrupted financial protection for their loved ones throughout the desired period.

Riders

In the Indonesian life insurance market, “asuransi jiwa” policies often come with the flexibility to include riders, which are optional add-ons that provide additional coverage beyond the basic death benefit. These riders serve as valuable enhancements, tailoring the policy to meet specific needs and circumstances.

The significance of riders in “asuransi jiwa” lies in their ability to expand the scope of protection. For instance, a disability rider provides coverage in the event of the policyholder becoming disabled due to an accident or illness, offering financial support during a period when earning capacity may be compromised. Similarly, an accidental death benefit rider offers an additional payout if the policyholder’s death occurs due to an accident.

Real-life examples illustrate the practical value of riders. Consider a policyholder who purchases a disability rider and subsequently suffers a debilitating accident. The disability rider ensures that they continue to receive a portion of their income, mitigating the financial impact of their inability to work. In another instance, an accidental death benefit rider provides a substantial payout to the policyholder’s family in the event of their untimely demise due to an accident, helping to cover expenses and maintain their standard of living.

Understanding the connection between riders and “asuransi jiwa” empowers policyholders to make informed decisions about their insurance coverage. It highlights the importance of considering riders as complementary components that can enhance the policy’s effectiveness and provide comprehensive protection against life’s uncertainties.

Investment Component

In the realm of “asuransi jiwa” (life insurance), the investment component plays a multifaceted role, blending financial protection with the potential for long-term wealth accumulation.

- Growth Potential: The cash value component acts as an investment vehicle, accumulating value over time. This accumulation can provide a potential return on investment, offering policyholders a valuable financial asset.

- Tax-Deferred Growth: A key advantage of the investment component is its tax-deferred growth. This means that the accumulated cash value grows without being subject to current taxation, allowing it to compound more efficiently.

- Loan Feature: Many life insurance policies with an investment component offer a loan feature. Policyholders can borrow against the cash value, accessing funds without surrendering the policy or affecting the death benefit.

- Supplemental Retirement Income: The accumulated cash value can serve as a source of supplemental retirement income. Policyholders can withdraw funds or annuitize the cash value to generate a steady income stream during their retirement years.

The investment component in “asuransi jiwa” provides policyholders with a unique opportunity to combine life insurance protection with the potential for financial growth. It offers a valuable tool for long-term financial planning, helping individuals build wealth while securing their loved ones’ financial future.

Frequently Asked Questions about “Asuransi Jiwa” (Life Insurance)

This section aims to address common queries and misconceptions surrounding “asuransi jiwa” (life insurance) to provide a comprehensive understanding of its significance and benefits.

Question 1: What is the purpose of “asuransi jiwa”?

Answer: “Asuransi jiwa” provides financial protection for the policyholder’s beneficiaries in the event of their untimely demise. It ensures that the beneficiaries have access to funds to cover expenses such as funeral costs, outstanding debts, and living expenses.

Question 2: Who can benefit from “asuransi jiwa”?

Answer: Individuals with financial dependents, such as spouses, children, or aging parents, can greatly benefit from “asuransi jiwa.” It provides peace of mind knowing that their loved ones will be financially secure in the event of their passing.

Question 3: How much coverage should I get?

Answer: The appropriate coverage amount depends on individual circumstances and financial obligations. Factors to consider include income, expenses, debts, and the number of dependents.

Question 4: What is the difference between a term life insurance and a whole life insurance policy?

Answer: Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage. Whole life insurance also has a cash value component that accumulates over time and can be borrowed against or withdrawn.

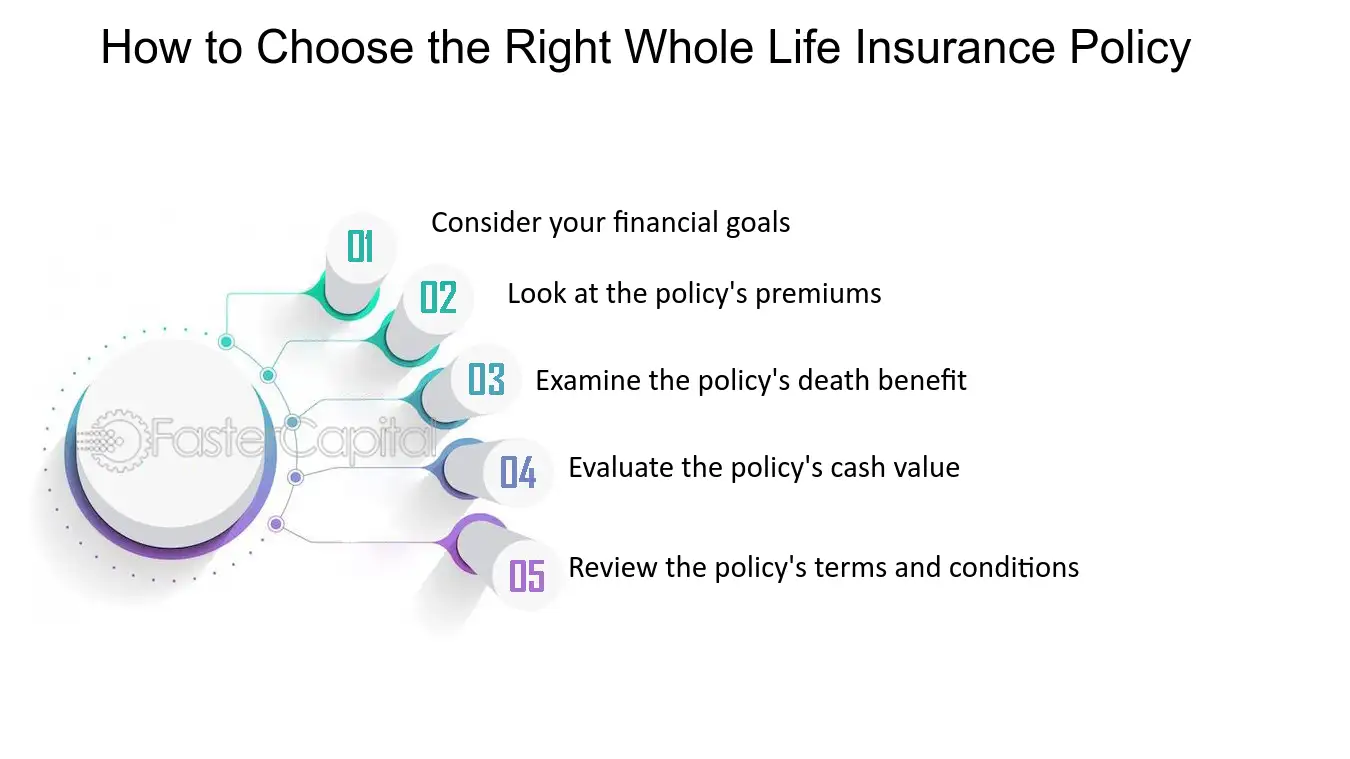

Question 5: How do I choose the right life insurance policy?

Answer: Consider your financial situation, coverage needs, and long-term goals. It is advisable to consult with an insurance agent or financial advisor to determine the most suitable policy.

Question 6: Is “asuransi jiwa” a good investment?

Answer: While “asuransi jiwa” primarily provides financial protection, some policies offer an investment component that can accumulate cash value over time. This component can provide a potential return on investment and serve as a supplement to other financial investments.

Understanding these frequently asked questions can help individuals make informed decisions about “asuransi jiwa” and ensure that they have adequate financial protection in place for their loved ones.

Transition to the next article section:

In the following section, we will delve into the advantages of incorporating “asuransi jiwa” into a comprehensive financial plan.

Tips for Maximizing the Benefits of “Asuransi Jiwa” (Life Insurance)

Incorporating “asuransi jiwa” into a financial plan can provide numerous advantages. Here are some tips to help you optimize the benefits of life insurance:

Tip 1: Determine Your Coverage Needs: Assess your financial obligations, income, and dependents to determine the appropriate coverage amount. Ensure that the death benefit is sufficient to cover expenses and maintain your family’s standard of living.

Tip 2: Choose the Right Policy Type: Consider your long-term goals and budget when selecting between term life insurance and whole life insurance. Term life insurance offers affordable coverage for a specific period, while whole life insurance provides lifelong protection and a cash value component.

Tip 3: Consider Riders and Additional Benefits: Explore optional riders that can enhance your coverage, such as disability riders, accidental death benefits, and critical illness coverage. These riders provide additional protection against specific events.

Tip 4: Compare Quotes from Multiple Insurers: Obtain quotes from several insurance companies to compare coverage options and premiums. This ensures that you get the best value for your money.

Tip 5: Disclose Your Medical History Accurately: Provide complete and accurate information about your medical history to the insurance company. Non-disclosure or misrepresentation can affect your coverage and claims.

Tip 6: Review Your Policy Regularly: Your life insurance needs may change over time. Periodically review your policy to ensure that it still meets your coverage requirements and financial goals.

Tip 7: Keep Your Beneficiaries Up-to-Date: Inform your beneficiaries about your life insurance policy and keep them informed of any changes. This ensures that they are aware of the benefits and can access them when needed.

Tip 8: Utilize the Cash Value Component (if applicable): If you have a whole life insurance policy with a cash value component, consider using it strategically. You can borrow against the cash value or withdraw funds for specific financial needs, such as education or retirement.

By following these tips, you can maximize the benefits of “asuransi jiwa” and ensure that your loved ones are financially protected in the event of your untimely demise.

Transition to the article’s conclusion:

In conclusion, “asuransi jiwa” is a valuable financial tool that provides peace of mind and financial security. By understanding the key aspects and benefits of life insurance, you can make informed decisions to protect your loved ones and secure their financial future.

Conclusion

In exploring the multifaceted realm of “asuransi jiwa,” we have illuminated its significance as a cornerstone of comprehensive financial planning. Life insurance provides a safety net for individuals and their loved ones, ensuring financial stability in the face of life’s uncertainties. By understanding the key aspects, benefits, and nuances of “asuransi jiwa,” individuals can make informed decisions to secure their financial future.

Asuransi jiwa serves as a testament to the power of foresight and preparation. It is a proactive measure that allows individuals to safeguard their legacy and provide for their loved ones, even in the event of their untimely demise. By embracing the principles of life insurance, individuals can create a ripple effect of financial security that extends beyond their own lifetime, leaving a lasting impact on generations to come.