Asuransi motor or motorcycle insurance is an essential financial product that protects motorcyclists and their vehicles in the event of accidents, theft, or damage. It offers peace of mind and financial support to cover the costs associated with motorcycle-related incidents.

Owning a motorcycle comes with inherent risks. Motorcycles are more vulnerable to accidents due to their smaller size and lack of protection compared to cars. Asuransi motor provides a safety net by covering medical expenses, repair or replacement costs, and legal liabilities in case of an accident. It also offers coverage for theft or damage to the motorcycle, ensuring financial protection against unforeseen circumstances.

In many countries, asuransi motor is mandatory by law. However, even in places where it is not legally required, it is highly recommended as a responsible and prudent financial decision for motorcyclists. By investing in asuransi motor, riders can safeguard themselves and their assets against the financial consequences of motorcycle-related incidents.

Asuransi Motor

Asuransi motor, or motorcycle insurance, is a crucial financial product that offers protection and peace of mind to motorcyclists. It covers various aspects related to motorcycle ownership and usage, including:

- Coverage: Types of coverage offered, such as liability, collision, and comprehensive.

- Premiums: Factors influencing insurance premiums, like age, riding history, and motorcycle type.

- Claims: Process and requirements for filing insurance claims.

- Exclusions: Circumstances or situations not covered by the insurance policy.

- Legal Requirements: Laws and regulations regarding motorcycle insurance in different jurisdictions.

- Safety Features: Impact of safety features on insurance premiums and coverage.

- Financial Protection: Role of motorcycle insurance in safeguarding financial assets.

- Peace of Mind: Psychological benefits of having insurance coverage.

These key aspects collectively contribute to the importance of asuransi motor. Understanding these aspects helps motorcyclists make informed decisions, choose the right insurance coverage, and navigate the insurance process effectively. Ultimately, asuransi motor provides essential protection and financial security, enabling motorcyclists to ride with confidence and peace of mind.

Coverage

Asuransi motor, or motorcycle insurance, offers various types of coverage to cater to the diverse needs of motorcyclists. These coverage options provide financial protection against different scenarios and potential risks associated with motorcycle ownership and usage.

-

Liability Coverage:

Liability coverage protects motorcyclists against legal liabilities arising from accidents where they are at fault. It covers bodily injury and property damage caused to others. Liability coverage is often required by law and provides peace of mind by safeguarding motorcyclists from potential financial burdens.

-

Collision Coverage:

Collision coverage provides financial protection for the motorcycle itself in the event of an accident, regardless of who is at fault. It covers damage or destruction to the motorcycle, including repairs or replacement costs. Collision coverage is particularly important for new or expensive motorcycles.

-

Comprehensive Coverage:

Comprehensive coverage offers the most extensive protection, covering a wider range of scenarios beyond collisions. It includes coverage for theft, vandalism, fire, natural disasters, and other non-collision-related events. Comprehensive coverage provides comprehensive financial protection for motorcycles against various risks and uncertainties.

The type of coverage a motorcyclist chooses depends on their individual needs, risk tolerance, and financial situation. Asuransi motor with liability coverage is typically the minimum legal requirement, but adding collision and comprehensive coverage provides additional protection and peace of mind. Understanding the different coverage options and choosing the right one is crucial for motorcyclists to ensure adequate financial protection in the event of motorcycle-related incidents.

Premiums

Insurance premiums for asuransi motor, or motorcycle insurance, are not fixed and vary depending on several factors. These factors influence the insurance company’s assessment of the level of risk associated with insuring a particular motorcyclist and their motorcycle.

The primary factors that affect insurance premiums include:

- Age: Younger riders, typically under the age of 25, are considered higher risk and therefore pay higher premiums. This is due to their lack of experience and higher likelihood of being involved in accidents.

- Riding history: Motorcyclists with a clean riding record and no accidents or violations will generally qualify for lower premiums. Conversely, riders with a history of accidents or traffic violations will likely pay higher premiums.

- Motorcycle type: The type of motorcycle also influences insurance premiums. Sports bikes and high-performance motorcycles are often more expensive to insure than cruisers or touring motorcycles. This is because they are perceived as being more likely to be involved in accidents or stolen.

Understanding the factors that affect insurance premiums is important for motorcyclists because it allows them to make informed decisions about their coverage and potentially reduce their insurance costs. For example, riders can improve their riding history by taking safety courses or maintaining a clean driving record. They can also choose a motorcycle that is less expensive to insure. By considering these factors, motorcyclists can find the right asuransi motor policy that meets their needs and budget.

Insurance premiums are a crucial component of asuransi motor because they determine the cost of coverage. By understanding the factors that influence premiums, motorcyclists can make informed decisions about their insurance and ensure they have the right coverage at the right price.

Claims

Asuransi motor, or motorcycle insurance, provides financial protection in the event of accidents or other covered events. However, to receive this protection, motorcyclists must understand the claims process and requirements for filing insurance claims.

-

Notification of Loss:

The first step in filing an insurance claim is to notify the insurance company as soon as possible after an accident or other covered event. This can typically be done by phone, email, or through the insurance company’s website.

-

Documentation:

When filing a claim, motorcyclists will need to provide documentation to support their claim, such as a police report, medical records, and photographs of the damage. The insurance company may also request a recorded statement from the motorcyclist.

-

Investigation:

Once the claim is filed, the insurance company will investigate the claim to determine liability and the extent of the damages. This may involve interviewing witnesses, inspecting the motorcycle, and reviewing the motorcyclist’s riding history.

-

Settlement:

Based on the investigation, the insurance company will determine the amount of the settlement. The settlement may cover the cost of repairs, medical expenses, lost wages, and other damages. The motorcyclist may need to negotiate with the insurance company to reach a fair settlement.

Understanding the claims process and requirements is essential for motorcyclists to ensure they can receive the full benefits of their asuransi motor policy. By following the proper procedures and providing the necessary documentation, motorcyclists can expedite the claims process and maximize their recovery.

Exclusions

Asuransi motor, or motorcycle insurance, provides comprehensive coverage for motorcyclists and their vehicles. However, it is important to understand that insurance policies also have exclusions, which are circumstances or situations that are not covered by the policy. These exclusions vary from policy to policy, but they typically include:

- Intentional Acts: Damage or loss caused intentionally by the insured or a third party is typically not covered.

- Racing or Stunts: Accidents or damage resulting from racing, stunts, or other competitive activities are often excluded.

- Mechanical Failure: Wear and tear or mechanical breakdowns that are not caused by an accident are generally not covered.

- Unlicensed Riding: Riding a motorcycle without a valid license or while under the influence of alcohol or drugs is typically excluded.

Understanding the exclusions in an asuransi motor policy is crucial for motorcyclists to avoid unexpected financial burdens. By being aware of what is not covered, motorcyclists can make informed decisions about their coverage and take steps to mitigate risks that are not covered by their insurance policy.

Legal Requirements

Asuransi motor, or motorcycle insurance, is closely tied to legal requirements and regulations in different jurisdictions. Motorcycle insurance laws vary from country to country, state to state, and even city to city. Understanding these legal requirements is crucial for motorcyclists to ensure they are compliant with the law and have adequate coverage in the event of an accident.

In many countries, motorcycle insurance is mandatory by law. This means that all motorcyclists must have a valid insurance policy in order to operate their motorcycles legally. The minimum coverage required by law varies, but typically includes liability coverage, which protects the motorcyclist from financial responsibility in the event they cause an accident that results in injury or property damage to others.

In addition to mandatory insurance requirements, many jurisdictions also have laws and regulations that govern the types of coverage available, the claims process, and the rights and responsibilities of motorcyclists and insurance companies. These laws and regulations are designed to protect both motorcyclists and the public by ensuring that motorcyclists have access to affordable and comprehensive insurance coverage.

Understanding the legal requirements for motorcycle insurance in different jurisdictions is essential for motorcyclists to avoid legal penalties and financial burdens. By being aware of the laws and regulations that apply to them, motorcyclists can make informed decisions about their insurance coverage and ensure they are protected in the event of an accident.

Safety Features

In the realm of “asuransi motor” or motorcycle insurance, safety features play a significant role in determining insurance premiums and coverage. Motorcycles equipped with advanced safety features are generally considered lower risk and, therefore, qualify for lower insurance premiums.

- Anti-Lock Braking Systems (ABS): ABS prevents wheels from locking during braking, enhancing control and stability, and reducing the risk of accidents. Motorcycles with ABS are often eligible for discounts on insurance premiums.

- Traction Control Systems (TCS): TCS prevents the rear wheel from spinning excessively, improving traction and stability, particularly on slippery surfaces. Motorcycles with TCS may qualify for lower insurance rates.

- Airbags: Airbags provide additional protection for riders in the event of a collision, reducing the risk of serious injuries. Motorcycles equipped with airbags may be eligible for reduced insurance premiums.

- Anti-Theft Devices: Immobilizers, alarms, and tracking systems deter theft and make motorcycles less attractive to thieves. Motorcycles with anti-theft devices may qualify for discounts on comprehensive insurance coverage.

By investing in safety features, motorcyclists can not only enhance their safety on the road but also potentially lower their insurance costs. Insurance companies recognize the value of safety features and reward motorcyclists who prioritize their protection.

Financial Protection

Asuransi motor, or motorcycle insurance, plays a vital role in safeguarding the financial assets of motorcyclists. In the unfortunate event of an accident, motorcycle insurance provides a financial safety net, protecting riders from the potentially devastating costs associated with property damage, medical expenses, and legal liability.

Without adequate insurance coverage, motorcyclists could be held personally responsible for these expenses, which can quickly deplete their savings and other financial resources. Motorcycle insurance acts as a buffer against these financial risks, ensuring that motorcyclists can focus on their recovery and rebuilding their lives after an accident, rather than worrying about the financial burden.

Furthermore, motorcycle insurance can provide peace of mind and a sense of security for riders and their families. Knowing that they have financial protection in place can reduce stress and anxiety, allowing motorcyclists to enjoy their rides without the added worry of potential financial ruin.

Peace of Mind

Asuransi motor, or motorcycle insurance, provides more than just financial protection. It offers peace of mind and a sense of security that can have a profound impact on the well-being of motorcyclists.

- Reduced Anxiety: Knowing that they have insurance coverage can significantly reduce anxiety levels for motorcyclists. They can ride with confidence, knowing that they are financially protected in the event of an accident.

- Enhanced Focus: Without the worry of potential financial burdens, motorcyclists can focus more fully on the road and their riding experience, leading to increased safety and enjoyment.

- Improved Sleep Quality: The peace of mind that comes with insurance coverage can contribute to better sleep quality, as motorcyclists can rest easier knowing that they are protected.

- Increased Sense of Control: Motorcycle insurance provides a sense of control over the unexpected. Motorcyclists can feel more empowered to ride and explore, knowing that they have taken steps to mitigate financial risks.

The psychological benefits of asuransi motor extend beyond individual motorcyclists. It also contributes to the well-being of their families and loved ones, who can have peace of mind knowing that their motorcycling family member is financially protected.

Frequently Asked Questions about Asuransi Motor

Asuransi motor, or motorcycle insurance, is a crucial financial product that protects motorcyclists and their vehicles. To provide comprehensive information, here are answers to some frequently asked questions:

Question 1: Is motorcycle insurance mandatory?

Answer: Motorcycle insurance requirements vary by jurisdiction. In many countries and regions, it is mandatory by law to have at least basic liability coverage. It is essential to check the specific regulations in your area.

Question 2: What types of coverage are typically included in asuransi motor?

Answer: Motorcycle insurance policies typically offer a range of coverage options, including liability, collision, and comprehensive coverage. Liability coverage protects against legal liabilities to others, collision coverage covers damage to the insured motorcycle, and comprehensive coverage provides broader protection against various risks such as theft and natural disasters.

Question 3: How is the cost of motorcycle insurance determined?

Answer: Insurance premiums for asuransi motor are influenced by several factors, such as the rider’s age, riding history, type of motorcycle, and coverage options selected. Generally, younger riders, those with more accidents or violations, and owners of high-performance motorcycles pay higher premiums.

Question 4: What should I do if I need to make a claim on my motorcycle insurance?

Answer: In the event of an accident or other covered event, promptly notify your insurance company. Provide necessary documentation, such as a police report and photographs of the damage. Cooperate with the insurance company’s investigation and provide any requested information to facilitate a fair and timely settlement.

Question 5: Are there any exclusions to motorcycle insurance coverage?

Answer: Yes, most motorcycle insurance policies have exclusions. Common exclusions include intentional acts, racing or stunts, mechanical failures, and unlicensed riding. Carefully review your policy to understand what is not covered.

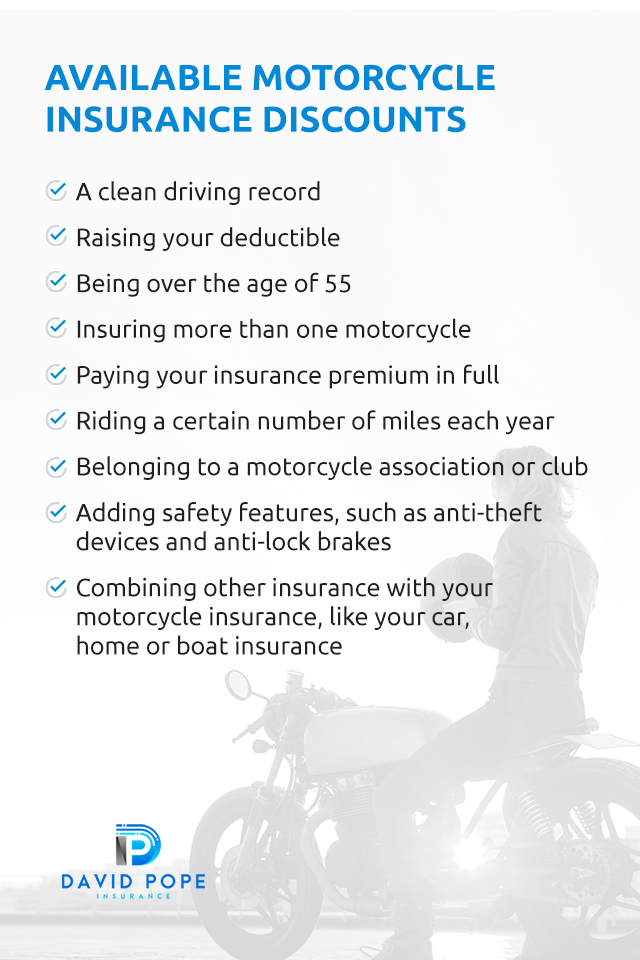

Question 6: How can I reduce the cost of my motorcycle insurance?

Answer: There are several ways to potentially lower your insurance premiums. Consider taking safety courses, maintaining a clean riding record, choosing a motorcycle with lower insurance rates, and installing anti-theft devices. Additionally, bundling your motorcycle insurance with other insurance policies from the same provider may qualify you for discounts.

These are just a few of the commonly asked questions about asuransi motor. By understanding the basics of motorcycle insurance, riders can make informed decisions to protect themselves financially and enjoy peace of mind on the road.

Transition to the next article section:

For more comprehensive information on asuransi motor, explore our other resources or consult with a licensed insurance professional.

Asuransi Motor Tips for Enhanced Protection and Savings

Asuransi motor, or motorcycle insurance, is a crucial financial tool that provides peace of mind and financial protection for motorcyclists. To maximize the benefits of your insurance policy, consider these valuable tips:

Tip 1: Choose the Right Coverage:

Assess your individual needs and risks to determine the appropriate coverage levels. Liability coverage is typically mandatory, while collision and comprehensive coverage offer broader protection.

Tip 2: Maintain a Clean Riding Record:

Avoid traffic violations and accidents to maintain a clean riding history. A good riding record can significantly lower your insurance premiums.

Tip 3: Install Safety Features:

Equip your motorcycle with safety features such as anti-lock brakes, traction control, and anti-theft devices. These features can enhance your safety and potentially reduce your insurance costs.

Tip 4: Take a Safety Course:

Enrolling in a motorcycle safety course demonstrates your commitment to safe riding. Insurance companies often offer discounts for riders who complete these courses.

Tip 5: Bundle Your Insurance:

If you have multiple vehicles or insurance policies, consider bundling them with the same provider. Bundling can result in significant savings on your insurance premiums.

Tip 6: Compare Quotes from Different Insurers:

Don’t settle for the first insurance quote you receive. Take the time to compare quotes from multiple insurance companies to find the best coverage at the most competitive price.

Tip 7: Review Your Policy Regularly:

Your insurance needs may change over time. Regularly review your policy to ensure that your coverage limits and deductibles still meet your requirements.

Tip 8: Understand Your Exclusions:

Familiarize yourself with the exclusions in your motorcycle insurance policy. Knowing what is not covered can help you avoid unexpected financial burdens.

By following these tips, motorcyclists can enhance their protection, potentially lower their insurance costs, and enjoy peace of mind on the road.

Conclusion:

Asuransi motor is an essential investment for motorcyclists. By understanding your insurance needs, making informed decisions, and following these tips, you can optimize your coverage and safeguard your financial well-being.

Kesimpulan

Asuransi motor is an indispensable financial protection for motorcyclists. It provides peace of mind and safeguards against financial burdens in the event of accidents, theft, or damage. Understanding the different coverage options, factors influencing premiums, and exclusions is crucial for choosing the right insurance policy.

By investing in asuransi motor, motorcyclists can ride with confidence, knowing that they are financially protected. It empowers them to enjoy the freedom of the open road without the worry of potential financial ruin. Asuransi motor is a testament to the importance of financial planning and risk management for motorcyclists.